Is smartphone manufacturing in Africa feasible and sustainable by 2030? Explore strategic insights, feasibility pillars, and Africa’s pathway to tech sovereignty.

Africa is now one of the world’s fastest-growing smartphone markets, yet more than 95 percent of smartphones used on the continent are imported. As digital access becomes the foundation for education, finance, healthcare, identity, and commerce, smartphones have shifted from communication devices into essential digital infrastructure. This reality raises a critical question for the continent’s digital future: Is smartphone manufacturing in Africa feasible and sustainable by 2030?

This question matters for two reasons. First, Africa’s digital economy is expanding rapidly, driven by a young population, increasing mobile connectivity, and rising demand for digital services. Second, smartphones now largely determine who participates in the digital economy. Without access to affordable smartphones, millions remain digitally excluded. For these reasons, smartphone manufacturing in Africa is no longer just a technological question—it is a matter of economic independence and digital sovereignty.

Africa also holds competitive advantages. The continent possesses many of the raw minerals required for electronics and battery production. It hosts one of the world’s largest and youngest consumer bases. And governments are increasingly introducing digital transformation agendas intended to expand industrial capacity and reduce dependency on imports. Combined, these factors create a strategic opportunity to transition from smartphone consumption to smartphone capability.

However, feasibility depends on more than demand and resources alone. It requires coordinated industrial policy, supply chain development, reliable infrastructure, technical workforce development, and regional collaboration. Without deliberate alignment, Africa risks remaining a consumer market rather than a manufacturing hub.

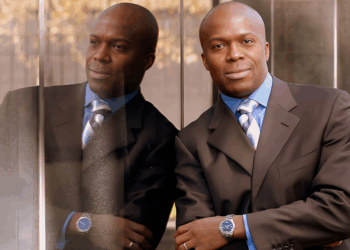

This article examines whether Africa can transition from smartphone consumption into a smartphone manufacturing ecosystem by 2030—evaluating feasibility, sustainability, competitiveness, and the strategic steps needed to make local production viable. Read on how Ayisi Makatiani is pioneering Africa towards its own AI Future.

1. Africa’s Smartphone Market Outpaces Local Supply

Smartphone adoption across Africa continues to accelerate, driven by mobile-first internet usage, digital services, fintech penetration, and rising connectivity across both urban and rural areas. For many Africans, the smartphone is not an optional device—it is the primary gateway to financial services, communication, learning, healthcare, and identity. As a result, smartphones have become a central pillar of Africa’s digital ecosystem and an enabler of economic participation in a rapidly evolving digital economy.

Yet while smartphone usage grows, Africa remains overwhelmingly dependent on imports. More than 95% of smartphones sold in African markets are assembled or manufactured outside the continent, and value capture takes place primarily through global supply chains and international brands. This represents a structural imbalance: Africa generates growing demand, yet retains very little of the associated industrial or economic value.

Africa’s Smartphone Market at a Glance

| Metric | Estimate |

| Current smartphone subscriptions | ~600M+ |

| Contribution to Africa’s GDP | ~7–8% |

| Forecast smartphone market value | ~$50B+ by early 2030s |

| Expected growth (2025–2033) | 6%+ annually |

| Internet access via mobile | Over 70% |

| Youth population share by 2030 | ~42% under age 25 |

Insight: Africa clearly has the scale, demand, and demographic momentum to sustain a large and expanding smartphone market. The question is no longer whether Africans will adopt smartphones—the question is whether Africa can capture a greater share of the economic and industrial value generated by that adoption. As demand grows toward 2030, the real strategic opportunity lies not only in smartphone consumption but also in building the capability to manufacture and assemble smartphones within the continent.

2. Why Smartphone Manufacturing Matters Beyond Devices

Local smartphone manufacturing in Africa offers far more than the ability to assemble or produce mobile devices. Smartphones today sit at the center of Africa’s digital ecosystem—they enable participation in financial services, digital identity solutions, healthcare platforms, remote learning, e-commerce, and even government services. As digital economies expand across the continent, smartphones are increasingly shaping who participates, at what level, and with what opportunities. In this sense, smartphones are no longer consumer electronics; they represent core digital infrastructure.

Developing smartphone manufacturing in Africa means the continent would not only adopt external technology but also begin shaping, building, and owning the means of digital access. That ownership matters strategically. It determines how value is created, who benefits, and which capabilities accumulate locally. As the global economy becomes more technology-driven, the countries that manufacture digital devices hold structural advantages over those that only import them.

Strategic advantages

- Job creation and industrial employment

- Technical skills development

- Electronics ecosystem formation

- Reduced import dependency

- Lower retail pricing

- Region-specific product design

- Supply-chain resilience and security

Local production also helps address Africa’s affordability problem. Devices manufactured closer to the end user reduce shipping, taxes, and distribution costs—making entry-level smartphones more accessible and accelerating digital inclusion. In turn, this strengthens markets for digital services and generates economic spillovers that extend beyond smartphones themselves.

Interpretation: Smartphones are the first significant industrial step toward Africa’s long-term technology capability, making smartphone manufacturing in Africa a foundational pathway toward broader digital sovereignty and future technology industries.

3. Feasibility Factors Defining Smartphone Manufacturing in Africa

The feasibility of smartphone manufacturing in Africa rests on coordinated alignment of industrial capacity, demand, and demographic momentum; the ability to establish and sustain smartphone manufacturing; policy planning; market demand; and regional integration. While Africa clearly has demand and demographic momentum, the ability to develop and maintain smartphone manufacturing depends on building an enabling environment that supports long-term competitiveness. These conditions are not theoretical—they are structural pillars that determine whether Africa can evolve from a smartphone consumption market into a smartphone production ecosystem.

Five Feasibility Pillars

| Pillar | Strategic Value |

| Market Scale | Large and growing user base |

| Minerals and resources | Batteries + electronics inputs |

| Workforce | Young, trainable population |

| Industrial Infrastructure | Energy + logistics |

| Policy Environment | Industrial incentives |

Takeaway: Feasibility exists. The issue is coordinated execution.

Resource and mineral advantage

Africa holds a significant share of global minerals used in smartphone batteries and components—lithium, cobalt, manganese, and rare earths among them. This gives Africa a natural advantage in developing downstream electronics capability and reduces long-term reliance on imported components. If leveraged strategically, Africa could establish competitive supply-chain segments, positioning itself not only as a market but as a production actor in global electronics.

Workforce and technical capacity

Africa’s workforce is young, increasingly educated, and digitally adaptive. With proper investment in vocational electronics training, engineering programmes, and hands-on technical development, the continent can build a skilled talent base for assembly, testing, logistics, and even component design. This human-capital advantage is a key long-term enabler for manufacturing and broader technology industries.

Policy incentives

Sustained local production requires deliberate industrial policy—import substitution frameworks, tax incentives, favourable regulatory conditions, and technology transfer requirements. Several African governments have begun taking early steps in this direction, signalling a willingness to support domestic manufacturing initiatives.

Market scale

A continent of more than one billion potential users gives Africa unparalleled market depth. Multiple regional hubs could supply local and neighbouring markets, reducing dependency on external supply and allowing Africa to build shared industrial capacity rather than importing value through finished devices.

4. Challenges Africa Must Solve

Africa must address a set of structural and industrial challenges before smartphone manufacturing becomes viable and competitive at scale. These challenges directly shape production costs, operational reliability, and investor confidence.

Infrastructure reliability remains a significant constraint.

Roughly 600 million people across the continent still lack reliable access to electricity, leading to power interruptions and high energy costs that continue to limit industrial productivity. Manufacturing requires stable power and predictable operations—conditions that remain inconsistent in many regions today.

High logistics and energy costs weaken competitiveness

Infrastructure gaps in transport, energy, and ICT raise production and logistics costs, making manufacturing more expensive relative to global competitors. Trade-related costs in Africa are estimated to be about 50% above the global average, which affects assembly, component sourcing, and distribution.

Limited industrial investment slows capability development.

African economies typically invest only 1–1.5% of GDP annually in infrastructure, far below the levels of those that successfully scaled electronics manufacturing. Without accelerated investment in industrial parks, transport corridors, and energy systems, manufacturing will remain fragmented and cost-heavy.

Component dependency increases exposure to global supply chains

Although Africa produces the minerals used in electronics, most intermediate components still need to be imported, creating costs, delays, and continued dependency. Building local supply-chain capability is a long-term requirement for competitive manufacturing.

Affordability pressures remain a defining factor.

A large share of African consumers depend on low-cost devices, and unless local manufacturing can reduce final retail pricing, imported smartphones may continue to dominate entry-level segments.

Insight:

These challenges are solvable through industrial policy, regional integration, and long-term planning—but they must be addressed deliberately, not assumed away.

5. Africa’s Strategic Advantage by 2030

Africa has a set of structural strengths that directly influence the feasibility and sustainability of smartphone manufacturing. These advantages are not future projections; they are realities already shaping Africa’s digital trajectory.

A young, growing, and digitally oriented population

Africa is the world’s youngest continent, with more than 60% of its population under 25. By 2030, African youth will represent an estimated 42% of the world’s young people, making Africa the future labour and consumer powerhouse of the digital age. This demographic profile creates both a large domestic smartphone market and a deep talent pool for industrial and technical development.

Expanding mobile connectivity and economic weight

Mobile technologies already contribute close to 7–8% of Africa’s GDP, equivalent to more than US$200 billion. Forecasts suggest that by 2030, the value of Africa’s mobile economy could reach US$270 billion, driven by digital services, fintech, and mobile-first business models. As smartphone adoption accelerates, demand for devices will continue to expand across the continent.

A multi-billion-dollar device market

The African smartphone market is projected to grow to nearly US$53 billion by 2033, expanding at approximately 6% annually. This scale provides sufficient demand to support regional manufacturing hubs, reduce import dependency, and shape a competitive consumer market for locally assembled devices.

A unique natural resource base

Africa possesses minerals essential to the production of electronics and batteries. This raw-material advantage, if strategically leveraged, can support local value chains in battery and components manufacturing over time.

Strategic narrative:

Africa’s transition from consumer to producer is not aspirational; it is increasingly feasible by 2030 if industrial policy, investment, and regional cooperation align with these existing structural strengths.

6. Emerging Regional Signals and Early Lessons

Although large-scale smartphone manufacturing in Africa is still developing, real examples across several countries show rising capability, interest, and early policy alignment. These initiatives remain relatively small in volume, but they demonstrate that smartphone manufacturing in Africa is more than theoretical—it is already underway in practical and commercially tested forms.

Early device assembly and manufacturing plants

In Rwanda, Mara Phones launched production lines in 2019 with a facility capable of assembling more than a thousand devices per day. Egypt has taken a more partnership-driven approach, with international brands including Samsung, Oppo, Vivo, and Nokia assembling devices locally for the Egyptian market. In Kenya, East Africa Device Assembly Kenya Limited (EADAK) was established to assemble smartphones locally for domestic and regional markets, reflecting growing investor confidence and government involvement in digital manufacturing initiatives.

Growing public and private sector commitment

These developments are supported by national strategies that prioritise import substitution, technology transfer, and special economic zones. Whether through government backing, private-sector investment, or mixed financing, the trend suggests recognition that local assembly contributes to industrial learning, skills development, and reduced dependence on imported finished devices.

Proof of concept—not yet scale

Most current operations remain assembly-led and depend heavily on imported components such as displays, processors, and camera modules. Scale is still modest relative to global production hubs, but these initiatives are strategically valuable. They demonstrate feasibility, build workforce capability, and establish institutional knowledge essential for future component manufacturing.

Insight:

These early African initiatives do not yet represent complete electronics manufacturing—but they provide foundational capability, proof of concept, and critical learning that can evolve into regional manufacturing ecosystems with sustained investment and policy alignment.

7. The Sustainability Question

Manufacturing sustainability extends beyond compliance — it is ultimately about industrial viability, environmental responsibility, and long-term social license. As Africa considers building its own smartphone production capacity, the sustainability dimension must be central. Without careful planning, increased device production could amplify waste, pollution, and resource depletion as much as it produces jobs and value.

Global e-waste is surging — Africa must be prepared.

In 2022 alone, the world generated 62 million tonnes of electronic waste (e-waste) — a record high — and projections suggest that by 2030, global e-waste could reach 82 million tonnes annually. Only 22.3% of that waste was documented as properly collected and recycled. If Africa scales smartphone manufacturing without planning for end-of-life management, the continent risks inheriting a large share of the global e-waste burden.

Resource sourcing and energy footprint cannot be ignored.

The manufacturing process for smartphones is resource-intensive: from mining rare earths and metals to energy consumption during assembly. Producing a single smartphone can result in significant CO₂ emissions and resource depletion — a global concern documented by recent lifecycle-assessment studies. In an African context, where many countries still rely heavily on fossil-fuel-based electricity and inefficient supply chains, this environmental toll could undercut the intended benefits.

Need for local circular economy and responsible sourcing

To avoid the pitfalls, any plan for smartphone manufacturing in Africa must embed circular economy models from the start:

- responsible sourcing of raw materials

- renewable energy integration in manufacturing plants

- robust e-waste recycling systems

- repair, refurbishment, and take-back programs

- safe waste-disposal protocols

Looking at global data, less than a quarter of e-waste is recycled effectively — and that needs to be urgently corrected if Africa wants sustainable manufacturing.

Insight:

Sustainability will become a competitiveness factor — not only a regulatory or ethical requirement. African manufacturers who embed responsible sourcing, energy efficiency, and circular-economy frameworks will not only mitigate environmental risk — they will build durable industrial capability, consumer trust, and long-run cost advantage.

8. Strategic Pathways to 2030

Africa’s ability to establish competitive smartphone manufacturing hinges on its willingness to treat the opportunity not merely as a technology project, but as an industrial transformation agenda. Successful smartphone manufacturing in Africa requires coordinated regional planning, decisive industrial policy, and deliberate investment in capabilities rather than short-term assembly incentives. Other late-industrializing economies have shown that such transitions are possible—but only through coordinated strategy, not isolated experimentation.

Lessons from successful industrialization models

China built global electronics dominance through integrated special economic zones, supply chain clusters, and technology transfers tied to foreign investment. Vietnam followed a similar pathway, progressing from assembly to component manufacturing through aggressive FDI attraction and electronics-focused industrial policy. India—once heavily import-dependent—now manufactures a significant share of its mobile phones domestically through its Production Linked Incentive scheme. These examples share one principle: industrial outcomes require deliberate policy direction, not market spontaneity.

Africa needs regional—not national—manufacturing ambition.

The African market exceeds one billion people, yet production is fragmented across small national markets with varying regulations, taxation systems, and investment climates. Until markets operate as unified industrial territories—where components, expertise, and final products move freely—Africa will struggle to match the scale advantages Asia enjoys. AfCFTA represents a structural opportunity to harmonise standards, incentivise regional manufacturing zones, and attract electronics supply chains that serve continental demand rather than individual national markets.

Build capability first—then supply chains

Africa is unlikely to produce displays, processors, or memory modules in the short term. But it can master assembly, refurbishment, battery technologies, and eventually select components—especially those linked to natural resources already present in Africa. The path to deeper electronics capability is sequential, not instantaneous.

State strategy must anchor industrial ambition.

Public policy must be unambiguous: attract investment that builds capability rather than merely assembling imported parts. This means conditional incentives, technology-transfer requirements, investment protection, and financing mechanisms tied to measurable local value creation. Without enforceable outcomes, Africa risks repeating the pattern of extracting raw materials and importing finished devices.

Strategic point:

Africa’s real advantage will emerge only when governments, regional institutions, and private sector coalitions build a continental manufacturing ecosystem—one that moves step by step from assembly to components to electronics capability. This is not guaranteed. But with strategic direction, Africa can build the industrial foundations necessary to compete in tomorrow’s digital economy.

9. Realistic 2030 Outlook

If Africa aligns policy, infrastructure, and investment, by 2030, the continent could move beyond pilot projects into integrated regional smartphone manufacturing ecosystems that are both commercially viable and socially transformative.

Regional hubs, cheaper devices, deeper inclusion

By anchoring production in a few well-connected regional hubs—East, West, North, and Southern Africa—the continent could realistically assemble tens of millions of smartphones annually, serving domestic and neighbouring markets. Local production, better logistics, and rationalised tariffs could reduce the final cost of entry-level smartphones by perhaps 20–30% compared to fully imported devices, making smartphones more affordable for low-income users and accelerating digital inclusion across rural and peri-urban communities.

As device penetration rises, digital services—from fintech to e-government and online learning—scale more quickly, amplifying the developmental impact of each locally assembled device.

Kenya’s skills shift: a template for a manufacturing-ready workforce.

For this vision to work, Africa needs a workforce that is not just educated, but practically skilled and solution-oriented. Kenya’s recent reforms point in that direction. The shift to a Competency-Based Curriculum (CBC) in basic education and Competency-Based Education and Training (CBET) in TVET is explicitly designed to produce job-ready, skills-focused graduates who can solve real-world problems rather than pass exams.

Kenya’s TVET bodies have already developed hundreds of competency-based TVET curricula aligned with industry needs, with modular CBET allowing trainees to enter the job market faster and upskill as technology evolves.

This kind of pipeline—technicians who understand electronics, automation, digital tools, and maintenance—is precisely what smartphone assembly plants, component facilities, and repair ecosystems require.

Outlook summary:

Suppose more African countries follow a similar skills-first approach, and by 2030, the continent will host not only regional smartphone assembly hubs but also other industries. In that case, it will also have a workforce trained to keep pace with rapidly changing technology, turning manufacturing from a policy aspiration into an operational reality.

QUICK SCENARIO — Africa by 2030

- Local assembly becomes mainstream

- Continent shifts from import dependency

- Electronics supply chains begin maturing

- Africa becomes a viable alternative for global suppliers

- Workforce becomes technically skilled and industry-ready

10. Beyond Smartphones — Africa’s Industrial Moment

Smartphone manufacturing is far more than an electronics opportunity; it is an entry point into Africa’s industrial future. A continent that learns to build the devices it depends on will inevitably learn to make other technologies that define tomorrow—from computers and medical equipment to IoT devices, robotics, AI hardware, and smart infrastructure. In that sense, smartphones are not the end—they are the beginning of Africa’s electronics industrialisation journey.

Countries that industrialised late, such as Vietnam and India, began with assembly and progressively advanced toward components, semiconductor fabrication partnerships, and design capacity. Africa’s pathway can follow a similar logic: start with assembly, move into repair and refurbishment, expand to battery value chains, and eventually evolve into components and advanced electronics manufacturing. Each step builds skills, supply chains, and industrial capability.

This is the fundamental transformation: shifting Africa from a commodities exporter into a value-adding, capability-building, technology-producing continent. Every smartphone assembled locally builds know-how, industrial discipline, technical talent, and economic sovereignty.

What begins with smartphones can unfold into industrial diversification, digital sovereignty, and local value creation across multiple industries. If executed with strategic intent, smartphone manufacturing becomes Africa’s first significant step toward building the technologies that shape the future rather than consuming technologies produced elsewhere.

Insight:

Smartphones are not simply devices—they are the industrial foundation of Africa’s technological maturity.

Africa Must Build the Technologies It Depends On

Africa’s digital future cannot depend on imported devices or external technological decisions. If smartphones are the primary gateway to the continent’s digital economy, then producing them locally becomes a strategic necessity rather than a theoretical aspiration. Africa’s digital sovereignty will be measured not only by connectivity and innovation, but also by the ability to build the physical technologies that enable it.

The continent has market scale, demographic strength, resource advantage, and rising digital demand. It also has early examples of assembly, policy interest, and industrial experiments that prove capability. What remains is not possibility—but commitment: long-term planning, coordinated industrial strategy, regional supply-chain integration, and sustained investment in people, skills, and manufacturing infrastructure.

The lesson from other late-industrialising economies is clear. Capability begins with assembly but evolves, step by step, into components, electronics ecosystems, and advanced manufacturing. Africa’s trajectory can follow the same logic—if it is guided by vision, humility, and long-term commitment rather than short-term outcomes.

What Africa builds today will define the technologies it depends on tomorrow. The next decade offers a historic opportunity to transition from consumption to capability, from buyer to builder, from observer to participant in global technology value chains. The decision now rests not on potential, but on strategic intent—and collective will.