The Financial Backbone of a Nation

In Kenya’s economic bloodstream, M-Pesa is the circulatory system. Launched in 2007 as a mobile money transfer service, it has evolved into a multi-layered financial ecosystem that underpins transactions from the smallest kiosk purchase to multi-million‑shilling corporate settlements. Today, M-Pesa monopoly in Kenya is undeniable.

The scale is staggering. According to Safaricom’s FY25 results, M-Pesa processed KES 35.8 trillion in transactions over the year — a figure equivalent to more than half of Kenya’s GDP. Active monthly users in Kenya stand at 30.5 million, with penetration rates exceeding 80% of the adult population. The platform’s reach extends into every sector: agriculture payments, school fees, utility bills, e-commerce checkouts, and even government disbursements.

Its economic impact is measurable. A 2024 World Bank study estimated that M-Pesa has lifted 2% of Kenyan households out of extreme poverty since its inception, primarily by enabling secure savings, remittances, and micro‑enterprise growth. For SMEs, it has reduced cash‑handling risks and expanded customer bases beyond geographic constraints.

Yet, this ubiquity also creates systemic dependency. As one Nairobi fintech CEO put it, “M-Pesa is not just a payment option — it’s the payment default. If it goes down, the economy holds its breath.” This centrality is both a testament to its success and a source of strategic vulnerability for the nation’s digital economy. Big question: Is M-Pesa monopoly in Kenya healthy?

Read Safaricom Deep Drive Series: Part 1 | Part 2 | Next (Part 4)

Innovation Enabler or Innovation Tax?

M-Pesa’s role as an innovation catalyst is undeniable. It has spawned an entire fintech ecosystem — from micro‑lenders like Tala and Branch, to savings platforms like M-Shwari and KCB M-Pesa, to merchant solutions like Lipa na M-Pesa. By providing a trusted, widely adopted payment rail, it has lowered the barrier to entry for digital entrepreneurs.

However, the same rails that enable can also extract. Transaction fees, while individually small, accumulate into significant costs for high-volume businesses and low-margin traders. For example, a merchant processing KSh 1 million monthly through Lipa na M‑PESA can incur fees exceeding KSh 15,000 — a material expense in competitive sectors.

Critics argue that Safaricom’s pricing structure functions as an “innovation tax” — a cost of participation in the digital economy that disproportionately affects startups and SMEs. While Safaricom has introduced zero-rated transactions for select services (notably during the COVID-19 pandemic), these have often been temporary or limited in scope.

The tension is strategic: M-Pesa’s profitability is a cornerstone of Safaricom’s financial performance, contributing 36% of total revenue in FY25; yet, aggressive monetization risks are stifling the very ecosystem it helped create. As one policy analyst noted, “You can’t claim to be the champion of financial inclusion while making inclusion expensive.”

API Access, Developer Friction, and Market Control

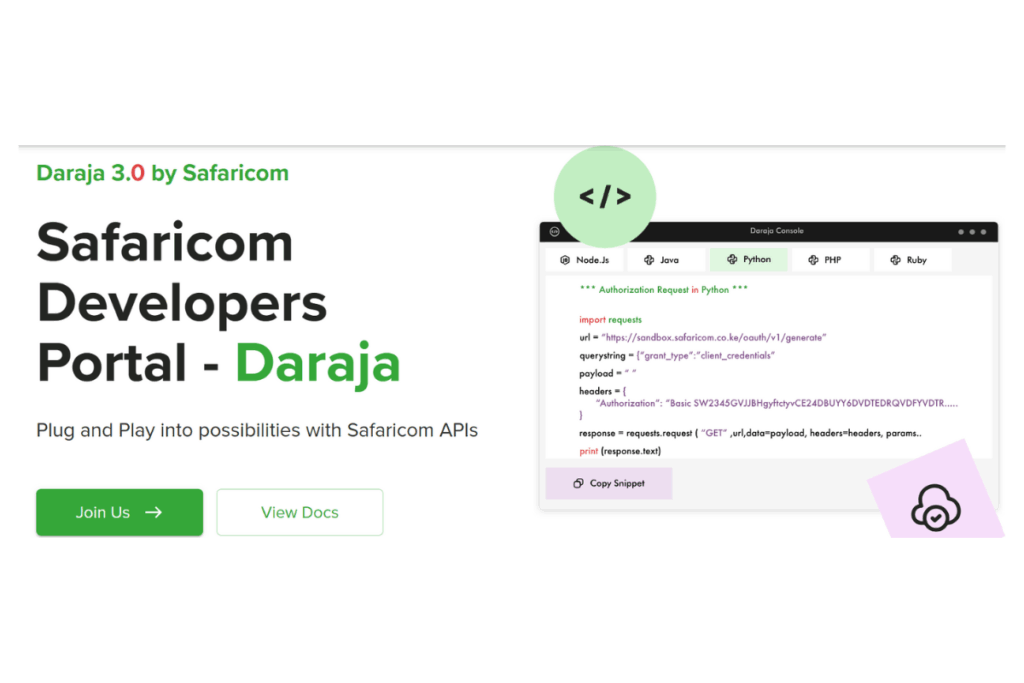

In theory, M-Pesa’s open APIs should be a launchpad for innovation. In practice, developers often encounter friction. Onboarding can be slow, documentation inconsistent, and integration costs high for early-stage ventures.

Safaricom’s Daraja API platform has improved access compared to the pre-2017 era, but feedback from the developer community suggests room for greater transparency and support. A 2024 survey by the Association of Fintechs in Kenya (FINTAK) found that 42% of respondents cited “complex integration processes” as a barrier to launching M‑PESA‑enabled products.

This friction has strategic implications. In markets like Nigeria, where payment APIs from providers such as Flutterwave and Paystack are designed for rapid, low-cost integration, fintech innovation has flourished. Kenya’s ecosystem, while vibrant, risks being constrained by the gatekeeping effect of a single dominant payment rail.

Moreover, Safaricom’s control over M-Pesa’s core infrastructure gives it de facto regulatory influence. Decisions regarding API pricing, transaction limits, and service availability can have a significant impact on entire market segments. While this control ensures stability and security, it also raises questions about competitive neutrality — especially as Safaricom launches its own products in verticals where third-party developers are active.

The Regional Ripple Effect

M-Pesa’s influence is no longer confined to Kenya. Its expansion into Tanzania, Mozambique, the Democratic Republic of Congo, Lesotho, Ghana (via Vodafone), and most recently Ethiopia, positions it as a potential pan‑African payment standard.

The Ethiopia case is instructive. Since launching in 2023, M-Pesa Ethiopia has signed up over 4 million customers and processed KSh 120 billion in transactions by mid-2025, despite regulatory hurdles and a competitive mobile money landscape dominated by state-linked Ethio Telecom’s Telebirr. Safaricom’s strategy has been to leverage its Kenyan playbook — rapid merchant onboarding, aggressive marketing, and partnerships with banks — while adapting to local regulatory frameworks.

Cross-border payments are the next frontier. The East African Community (EAC) and African Continental Free Trade Area (AfCFTA) both envision seamless intra-African trade, and interoperable mobile money systems are critical to that vision. M-Pesa has piloted cross-border remittance corridors with Tanzania and Rwanda, but scaling these requires harmonised regulations, currency settlement mechanisms, and competitive pricing.

Here, the toll booth question resurfaces. If M-Pesa becomes the dominant cross-border payment method, will it facilitate trade at minimal cost, or will it extract rents that slow down adoption? The answer will shape not just Safaricom’s regional reputation, but Africa’s broader digital integration trajectory.

Strategic Imperatives for the Next Decade

The M-Pesa dilemma is not binary. It is a spectrum of strategic choices between maximising shareholder returns and maximising ecosystem growth. For Safaricom to remain both profitable and indispensable, several imperatives emerge:

- Pricing Reform: Introduce tiered transaction fees that protect low-margin businesses and incentivize high-volume usage.

- Developer Enablement: Streamline API onboarding, improve documentation, and offer sandbox environments that reduce integration costs for startups.

- Interoperability Leadership: Champion open standards for cross-border mobile money, positioning M-Pesa as the backbone of Africa’s digital trade.

- Risk Mitigation: Invest in redundancy and uptime guarantees to reduce systemic vulnerability from outages.

- Inclusive Innovation: Partner with micro‑merchants, rural cooperatives, and informal sector players to ensure M-Pesa’s benefits reach the economic periphery.

The Verdict on the Dilemma

M-Pesa is both a triumph of African innovation and a test of corporate stewardship. Its rails have carried millions into the digital economy. Still, the tolls it charges — in fees, integration friction, and market control — will determine whether it remains a catalyst or becomes a bottleneck.

For policymakers, the challenge is to preserve M-Pesa’s stability and reach while fostering competitive alternatives. For entrepreneurs, it is to innovate within and beyond its rails. And for Safaricom, it is to recognise that in the long arc of Africa’s digital future, trust and accessibility will be worth more than any quarterly earnings beat.

Ultimately, the question is not whether M-Pesa can dominate — it already does. The question is whether it will choose to lead in a way that multiplies opportunity, or in a way that merely collects rent on the continent’s most important digital highway.