Every great industry has a defining origin story. In mobile communication, that story begins with one name: Motorola. From pioneering the first handheld mobile phone to shaping decades of innovation, Motorola wasn’t just another tech company — it was the heartbeat of an entire era.

But like every giant, it experienced a dramatic rise, a stunning fall, and now, the possibility of a comeback few anticipated.

Today, as Africa becomes one of the world’s most dynamic mobile markets, the question is no longer what Motorola was, but what Motorola could become. The conversation around the Motorola comeback in Africa is gaining momentum — not just as nostalgia, but as a strategic opportunity at the intersection of history, technology, leadership, and emerging-market growth.

This deep dive explores Motorola’s journey from a small Chicago radio workshop to a global icon, its decline during the smartphone revolution, and why Kenya and Africa may be the stage for one of tech’s most intriguing revival stories.

And it all begins at the very start.

The Birth of a Giant — Motorola’s Golden Age

Every industry has its founding myth. In mobile communication, that myth has one name: Motorola.

Today, we carry supercomputers in our pockets. But rewind a century, and two brothers in Chicago were building radios in a small workshop, unknowingly laying the foundation for one of the most influential brands in technology. We go all out on ‘Motorola: From Radio Waves to Smartphones – The Untold Story, Its Rise, Fall, and What the Future Holds for Kenya & Africa.’ We start from the inception to possibilities, especially for Africa.

From Galvin Manufacturing to Motorola

In 1928, Paul and Joseph Galvin founded the Galvin Manufacturing Corporation. The US was entering the Great Depression, but the Galvins saw opportunity in making affordable car radios. In 1930, they branded their invention Motorola—a blend of “motor” and “Victrola,” symbolizing “sound in motion.”

This wasn’t just marketing. It was foresight. The idea of mobility and communication on the go would define Motorola for decades.

By the 1940s, Motorola was already shaping history. Its Handie-Talkie SCR-536 radio was a vital tool in World War II. Soldiers nicknamed it the “walkie-talkie,” a term that became part of the global vocabulary. Motorola wasn’t just selling gadgets—it was rewriting human communication.

1973: The Call That Shook the World

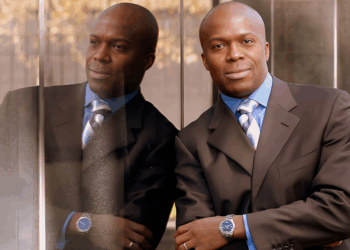

The moment that sealed Motorola’s place in history came on April 3, 1973. Martin Cooper, a Motorola engineer, stood on a sidewalk in New York, holding a 1kg prototype of the DynaTAC phone.

He dialed his rival at AT&T’s Bell Labs and uttered history’s first words from a handheld mobile:

“Joel, I’m calling you from a real handheld portable cell phone.”

That call changed everything. It wasn’t just about phones—it was about freedom. For the first time, humans could speak to one another without wires.

In 1983, Motorola released the DynaTAC 8000X commercially. It cost nearly $4,000, took 10 hours to charge, and gave just 30 minutes of talk time. Yet people bought it. For Wall Street bankers, politicians, and Hollywood stars, the DynaTAC was a symbol of power.

Innovation After Innovation

Motorola didn’t stop. The DynaTAC 8000X had just rolled things onto motion.

MicroTAC (1989) – The First Flip That Changed Everything

When Motorola unveiled the MicroTAC in 1989, the world gasped. Until then, mobile phones were bricks—bulky, heavy, and mainly for Wall Street executives or government officials. Then came this pocket-sized marvel, weighing just about 12 ounces (350 grams) and small enough to fit into a jacket pocket. Its revolutionary “flip” mouthpiece didn’t just reduce size; it made using a mobile phone feel futuristic, almost like something straight out of Star Trek.

The MicroTAC cost upwards of $3,000 at launch, but it quickly became a symbol of success for business elites who wanted to be seen at the cutting edge of tech. In major cities—whether in New York, London, or even early adopters in Nairobi’s upper-class neighborhoods—the MicroTAC became more than a communication tool. It became a badge of progress. The device also set the design blueprint that would dominate phones for the next 15 years: compact, sleek, foldable. For Motorola, it wasn’t just another phone; it was a bold statement—we can make the future fit in your pocket.

StarTAC (1996) – The Clamshell Icon That Made Phones Sexy

By 1996, Motorola had already cemented its reputation as a pioneer, but the StarTAC turned that pioneering into cultural dominance. Inspired by science fiction and cutting-edge design, the StarTAC became the world’s first truly iconic clamshell phone. Weighing just 88 grams, it was unbelievably light for its time and fit comfortably in the palm—ushering in a new era where phones weren’t just tools, but fashion statements. The StarTAC sold over 60 million units worldwide, a massive success in a market still emerging.

Hollywood couldn’t resist it: the phone appeared in blockbusters, music videos, and TV shows, instantly making it a pop-culture phenomenon. For many young professionals in big cities, the StarTAC wasn’t just a gadget—it was a passport to being “in.” It was the first phone you wanted people to see you use, a precursor to the idea of mobile phones as lifestyle accessories. Motorola had made something extraordinary: a device that was cool before the iPhone era ever arrived. It wasn’t just an innovation; it was a movement that blurred the line between technology and fashion.

RAZR V3 (2004) – The Phone That Defined a Generation

If the StarTAC was a phenomenon, the Motorola RAZR V3 was an earthquake. Launched in 2004, the RAZR was razor-thin (just 13.9 mm), metallic, and impossibly sleek. Its laser-etched keypad and aviation-grade aluminum body gave it a futuristic edge. This wasn’t just a phone; it was a design revolution. Motorola priced it high at launch—around $500—but it quickly became a must-have, eventually selling over 130 million units globally, making it one of the best-selling phones of all time. The RAZR wasn’t just popular in the West. In Nairobi, Lagos, Accra, and Johannesburg, it was status defined.

Pulling out a RAZR in a boardroom or a social gathering was the equivalent of flashing a gold Rolex or stepping out of a German luxury car. It was aspirational, fashionable, and yet functional. The RAZR showed that a phone could be art, a lifestyle symbol. Even today, the RAZR legacy lives on, with Motorola reviving it as a foldable smartphone, trying to channel the magic of that unforgettable moment in mobile history. For Motorola, this was the peak—when it wasn’t just competing in the market but leading global culture itself.

At this point, Motorola wasn’t simply competing. It was a leading culture.

Cracks in the Empire — Motorola’s Fight for Survival

Great empires rarely collapse overnight. They erode slowly, then all at once.

For Motorola, the cracks began appearing in the mid-2000s.

2007: The iPhone Tsunami

When Steve Jobs unveiled the iPhone in January 2007, Motorola was still basking in the glory of the RAZR. But the industry had shifted.

Phones were no longer just hardware—they were software ecosystems. The iPhone’s touchscreen and App Store redefined what consumers expected. Overnight, the RAZR looked outdated.

Motorola’s response? More RAZRs, more flip phones. It failed to see the future: smartphones were not about slimness, but about experience.

Android and a Missed Chance

To its credit, Motorola was an early Android adopter. In 2009, it launched the Motorola Droid, a phone that was hugely popular in the US and helped establish Android’s credibility.

But elsewhere, especially in Africa, Motorola’s Android presence was invisible.

Meanwhile, Samsung flooded markets with Galaxy phones. Nokia dominated Africa with affordable Symbian devices. And soon, Tecno and Infinix would rise, tailoring devices for African needs: affordable pricing, big batteries, dual-SIM support.

Motorola, despite its legacy, was absent.

Google Buys Motorola (2012–2014)

In 2012, Google acquired Motorola Mobility for $12.5 billion. The tech world buzzed—could this be Motorola’s rebirth?

But Google’s true goal was patents. Motorola held over 17,000 mobile technology patents, which were critical for defending Android against Apple’s lawsuits.

Two years later, in 2014, Google sold Motorola to Lenovo for just $2.9 billion. A brand once worth billions was now a corporate football.

Meanwhile in Africa…

This absence was costly. In Kenya, Nigeria, Ghana, and Tanzania, Transsion Holdings brands (Tecno, Infinix, Itel) grew aggressively. Their winning formula:

- Affordable smartphones (KES 7,000–15,000 range).

- Cameras optimized for African skin tones.

- Long-lasting batteries for regions with poor electricity.

- Dual SIM cards to switch between telcos.

By the late 2010s, Transsion controlled nearly 50% of Africa’s smartphone market. Motorola, once a pioneer, became an afterthought.

Resurrection Attempts

Lenovo tried to reboot Motorola with bold experiments:

Moto G Series (2013 – Present): The Affordable Hero That Quietly Won Hearts

In 2013, under Google’s brief ownership, Motorola introduced the Moto G, a phone that changed the budget landscape forever. At under $200, the Moto G offered something unheard of at the time: near-stock Android, decent hardware, and reliable performance without bloatware. Tech reviewers like The Verge and CNET called it “the best budget smartphone ever made.”

The Moto G series became Motorola’s survival line, especially in emerging markets like Latin America, India, and parts of Africa, where affordability was key. While premium flagships stole headlines, the Moto G quietly racked up sales and cultivated loyalty. In Kenya, markets like Jumia and Safaricom retail stores occasionally stocked Moto G devices, where they competed directly against Tecno Camon and Infinix Hot series.

The Moto G proved Motorola’s ability to listen to consumers who didn’t need luxury but demanded value. While it never reclaimed Motorola’s golden-age dominance, it established the brand as a trusted, dependable alternative for millions worldwide. In hindsight, the Moto G series was Motorola’s anchor during turbulent times—a reminder that survival often comes not from flash but from consistency.

Moto Z (2016) – The Bold Bet on Modular Phones

When Lenovo acquired Motorola in 2014, the world expected bold moves. Two years later, in 2016, they launched the Moto Z series, positioning it as a futuristic flagship that could compete with Samsung’s Galaxy and Apple’s iPhone.

The hook? Moto Mods—magnetic snap-on accessories like a JBL speaker, a Hasselblad camera add-on, or even a mini projector. It was ambitious, visionary, and truly innovative. Tech enthusiasts applauded the modular approach, calling it “Lego for phones.” Google had attempted something similar with Project Ara, but Motorola beat them to a commercial product.

The problem? Consumers weren’t ready. The Moto Z started at $699, and Moto Mods added $100–$300 extras. That made it niche, appealing only to die-hard geeks. Worse still, competitors were moving in other directions—Samsung betting big on displays and ecosystems, Apple doubling down on premium integration.

By 2019, modularity was dead, and so was the Moto Z line. Yet, the Moto Z showed that Lenovo was willing to take risks, even if the market wasn’t ready. In Africa, where affordability drives adoption, the Moto Z never took off. But its boldness remains a vital chapter—a glimpse of what Motorola could be if it dared to think differently.

RAZR Foldable (2019) – Nostalgia Meets the Future

In late 2019, Motorola made global headlines with the RAZR Foldable, a modern reimagining of the legendary RAZR V3. This wasn’t just a phone—it was an attempt to fuse nostalgia with futuristic foldable OLED technology. The RAZR Foldable featured a 6.2-inch foldable display, retro-inspired design, and a compact flip form factor.

Motorola timed it perfectly: Samsung had just launched its first Galaxy Fold, and Huawei was showing off the Mate X. The RAZR instantly became a talking point in tech media and nostalgic fans worldwide. But reality hit hard.

Priced at around $1,500, it was out of reach for most consumers, especially in cost-sensitive regions like Africa. Early reviews cited issues with durability, battery life, and performance compared to similarly priced flagships. In Kenya or Nigeria, where $300–$400 phones dominate sales, the RAZR Foldable remained a status symbol seen only in showcases, not streets.

Still, the move cemented Motorola’s narrative: it wasn’t afraid to reinvent itself, even at significant risk. The foldable RAZR didn’t topple Samsung or Apple, but it reminded the world of Motorola’s flair for daring design. And as foldable prices drop, Africa could yet see a second coming of the RAZR in the mainstream market.

Motorola was trying—but the market had moved.

Motorola Today and Tomorrow — Kenya and Africa’s Next Chapter

Fast forward to 2025. Motorola isn’t the giant it once was, but it isn’t gone either.

Where Motorola Stands in 2025: Numbers, Markets & Implications

Global Performance Under Lenovo

- In 2024, Motorola smartphone sales soared 21% year-on-year (YoY)—a massive leap compared to the global average growth of just 3%—resulting in its highest annual sales in a decade.

- Its average selling price (ASP) also jumped 17% YoY, signaling growing consumer acceptance of its mid-tier value + design positioning.

- The brand is gaining ground across regions outside Latin America, marking a significant diversification. Latin America now accounts for less than 50% of its portfolio for the first time since 2018 — a clear sign of global expansion.

Moto G’s Quiet Strength

- The Moto G family—Motorola’s workhorse in emerging markets—has crossed an impressive milestone of 200 million units sold over its 10-year history.

- That’s averaging 20 million units per year globally, reinforcing Moto G as the backbone of Motorola’s rebirth.

Regional Snapshot: Kenya & Africa in Focus

Kenya’s Smartphone Landscape (2025)

- As of February–June 2025, Samsung dominates with ~30.3% market share, up from ~24.3% in the previous year.

- Transsion brands, including Tecno and Infinix, are slipping: Tecno dropped to 13.4% (from ~17%) while Infinix sits at 7.6% (down from ~8.5%).

- Xiaomi posted growth too—rising from 5.38% to 7.46%, the most significant gain among Android players.

- Motorola’s share remains under the “Others” bucket, meaning well under 1%—a quiet presence despite global gains.

Connected Devices in Kenya

- Kenya now has approximately 72 million connected mobile devices as of early 2025—although this exceeds unique ownership (some users have multiple devices).

- This growing base underlines the vast potential for mid-tier brands that can crack value-conscious consumers.

Analytics: What This Means for Motorola in Africa

| Metric | Kenya/Africa | Implication for Motorola |

| Market Share | < 1% | Virtually invisible in mainstream retail |

| Moto G Lifetime Sales | 200M+ units globally | Credibility and trust in emerging markets |

| Regional Sales Growth | +21% YoY globally | Growth trajectory if localized effectively |

| ASP Growth | +17% YoY | Consumers are willing to pay more for a value-design combo |

| Connected Device Base | 72M+ in Kenya | Large addressable audience awaiting activation |

| Competitors’ Shifts | Samsung rising, Transsion declining | Opening for strategic plays in the mid-tier segment |

Strategic Takeaway for Kenya & African Markets

Motorola’s global gains have been powered mainly by its value-for-money mid-range strategy (Moto G series) and a shift into regions outside Latin America. But in fast-evolving markets like Kenya, where Samsung and Transsion still dominate, there’s a narrow window for Motorola to make an impact:

- Use the Moto G’s global credibility (200M sold) to gain trust in Kenya’s mid-tier segment.

- Build telco partnerships to tap into the 72 M-connected-device ecosystem.

- Price aggressively—between KES 18,000–30,000 (USD 140–240)—to undercut rivals while offering better quality, Monté Carlo aesthetics, or exclusive features.

In numbers, if Motorola captured even 2% of Kenya’s connected base (≈1.4 million devices), and assuming an average price of KES 22,000 (~USD 180), that’s potential revenue of ~KES 30.8 billion (USD 248 million)—a meaningful anchor for their Africa strategy.

Motorola must carve a unique value proposition to stand out.

Opportunities Ahead (2025–2030)

Affordable 5G: Motorola’s Golden Window

The single biggest unlock for Africa’s smartphone future between now and 2030 is affordable 5G at scale. In just a few years, Kenya has gone from early pilots to nationwide coverage. Safaricom reports 4G now reaches 97% of the population, while 5G is live in all 47 counties, with earlier disclosures noting ~14% population coverage across 102 towns. Airtel has followed closely, with 370+ 5G sites in 39 counties, and even smaller players like Equitel are piggybacking on Airtel’s 5G backbone to stay relevant. In Nigeria, MTN’s 5G footprint covered ~11.3% of the population by December 2023, with aggressive rollout plans aimed at pushing deeper into cities and rural corridors by mid-decade. The infrastructure is here; the missing piece is the device.

For Motorola, this creates a once-in-a-decade opening. The African smartphone market grew +7% YoY in Q1 2025, despite harsh macroeconomic conditions. That growth is being fueled not by luxury flagships but by value-driven, capable devices—precisely where Motorola’s Moto G and Moto E families thrive. Imagine a sub-$200 (KES ~26,000) 5G phone: clean Android, guaranteed long-term updates, and tuned specifically for African networks. Such a device could intercept first-time 5G switchers who today default to Transsion (Tecno, Infinix) or Xiaomi. At this price band, Motorola wouldn’t just compete—it could redefine expectations.

But price alone won’t win the game. African buyers expect endurance and reliability. That means 5,000mAh batteries or larger to compensate for early-generation 5G power drain, carrier aggregation tuned for Safaricom, Airtel, and MTN grids, and hardware that can gracefully fall back to 4G where coverage remains patchy. Software also matters: a clean Android without bloatware is a differentiator in markets tired of ad-heavy skins. If Motorola can add two years of OS upgrades and three years of security patches, it creates trust—a currency just as valuable as affordability.

The battlefield is clear: the KES 18k–30k ($140–$230) range is where the next wave of African smartphone users will be won or lost. Transsion has ruled this segment for years with aggressive pricing and localized features. Xiaomi is pushing hard with Redmi Note devices. If Motorola plays with discipline—balancing cost, reliability, and brand storytelling—it can carve out meaningful share. Affordable 5G isn’t just another product tier; it is the gateway to loyalty. Get it right, and every Moto G sold today becomes an upsell candidate for a foldable or premium Edge tomorrow.

In short, affordable 5G is the key to scale, the entry point to brand trust, and the foundation on which Motorola can build its African comeback.

Foldables for Africa: A Halo Play, Not a Mass-Market Bet

Foldable phones won’t take over Africa’s smartphone market tomorrow. But they matter for one reason: they shape the brand’s aura. And in Africa’s urban capitals—Nairobi, Lagos, Cairo, Johannesburg—status sells. Motorola’s RAZR heritage gives it a natural edge: it already wrote the rulebook on “fashion-first phones” two decades ago. Now it has the chance to rewrite it for a new era.

The challenge is cost. The first RAZR foldables launched around $1,500 (KES 200k+), far above the African sweet spot of KES 30k–60k. But costs are falling as flexible display yields improve and manufacturing scales increase. By 2026–27, mid-premium foldables in the KES 80k–100k band could become realistic for Africa’s rising middle class. That’s where financing, trade-in programs, and operator partnerships (Safaricom, MTN, Airtel) make the leap less painful.

Motorola can go further. Imagine “Kenya Edition” or “Africa Edition” RAZRs with Swahili system fonts, M-Pesa and Airtel Money widgets preloaded, and carrier-branded themes. Make the phone a cultural statement, not just a technical marvel.

Best strategy forward? Keep one flagship RAZR SKU in Kenya/Nigeria, sell it through telco flagships, seed it with influencers, and bundle 2-year screen care. This makes the RAZR a billboard for Motorola’s innovation while the Moto G and Moto E continue doing the heavy lifting in the mass market. In short, foldables sell the dream, mid-rangers sell the volume.

Localized Software

Selling phones in Africa isn’t just about hardware specs—it’s about making the software feel like home. This is where Motorola has room to win.

Imagine setting up a new Moto phone in Nairobi, Cairo, or Lagos. Instead of a generic Android screen, the device could instantly detect your SIM card and show you the best Safaricom or Airtel data plans, with M-Pesa or mobile money links already built in. That tiny detail turns a global brand into a local companion.

Language is another big win. Pre-installing Kiswahili, Hausa, Yoruba, and Amharic keyboards makes the phone more accessible, while built-in AI translation ensures low-bandwidth chats flow smoothly across languages. Even the camera experience can be localized: tuning for darker skin tones (something Transsion brands like Tecno nailed early) and adding regional watermark presets that small businesses can use to brand their photos.

Education, health, and small business tools also matter. Picture offline school lessons, clinic directories, or a simple inventory and receipts app preloaded—features that solve real problems for families, students, and MSMEs.

Moto Africa Services

Now here’s where Motorola could play its killer card: a “Moto Africa Services” bundle. Think of it as a lightweight, privacy-respecting, uninstallable platform where carriers, fintechs, and developers plug in local apps—without the clutter and stigma of bloatware. Want Safaricom Bonga Points? MTN music? A local edtech partner? All delivered via Moto Africa Services, streamlined and opt-in. This gives Motorola the agility of a startup with the trust of a global brand.

Finally, there’s the network reality: Africa’s 5G adoption may hit 30% by 2027, but 4G will still be the workhorse. Motorola must design its software to work gracefully on patchy networks—compressing images, syncing smartly, and never leaving users stranded.

In short, hardware opens the door, but localized software—backed by a Moto Africa Services bundle—keeps Motorola in the home and the future.

Telco Partnerships

In Africa, telcos decide who wins and who fades. Safaricom, in Kenya, is more than a network—it runs the money rails through M-Pesa, making it the single most powerful distribution partner in the country. In Nigeria, MTN and Airtel dominate rural coverage and handset financing. If Motorola wants to grow in Africa, these partnerships are the key.

The playbook is simple: bundle affordable 5G phones with telco plans. Imagine a Moto G 5G priced below KES 25,000, sold on 12-month installments directly through Safaricom. Each device could come with built-in M-Pesa integration and a daily data bundle (1.5–2 GB) so that users immediately feel the benefit of “5G-ready” phones.

The timing is perfect. Safaricom already covers all 47 counties with 5G, Airtel has rolled out over 370 sites across 39 counties, and MTN Nigeria has reached 11% of the population with 5G by December 2023. Coverage is no longer the barrier—it’s about making devices affordable and accessible.

For telcos, Motorola offers more than just consumer phones. There’s room for fleet pricing for SMEs, boda riders, and field agents—paired with rugged cases and same-day swaps. This kind of B2B2C approach could cement Motorola on telco shelves, while e-commerce platforms like Jumia and physical retail mop up additional demand.

In short: if Motorola ties itself to Africa’s telcos through installments, co-branded marketing, and rural reach, it doesn’t just sell phones—it sells solutions.

AI Integration

AI is no longer a gimmick; it’s a battery and bandwidth multiplier in Africa. Motorola can lean into Google’s on-device AI to deliver value that survives poor coverage: speech-to-text in Kiswahili, offline summarization/transcription for students and journalists, call-screening against fraud, and contextual camera prompts (business card OCR into WhatsApp contacts; receipt scanning into simple ledgers). Combine that with network-aware codecs that auto-downshift on congested cells.

For 5G zones (Kenya’s footprint widening; Nigeria’s MTN/Airtel scaling), enable real-time translation in calls, AR measurements for field technicians, and secure KYC for fintechs using on-device face-match that respects privacy. Tie device health to carrier APIs to preemptively throttle background sync when users near data caps—anxiety killer.

Anchor it with metrics users feel: 30–40% data savings via compression, 20% longer battery life with adaptive refresh, sub-1s camera capture with on-device scene detection. Market context is favorable: MEA shipments +7% YoY in Q1-2025, showing buyers respond to practical innovation, not just spec sheets.

Lessons from Motorola’s Journey

Innovation is Not Enough – Timing and Adaptability Matter More

Motorola was never short of ideas. From the MicroTAC in 1989 to the StarTAC in 1996, and the jaw-dropping RAZR V3 in 2004, it repeatedly showed the world that design and engineering brilliance could shape culture. But innovation without adaptation is fragile. When Apple launched the iPhone in 2007, Motorola was still chasing form factors instead of ecosystems. When Android began taking over, Samsung doubled down, but Motorola stumbled in strategy, missing the timing of software-led revolutions.

Africa offers a mirror today: being first with 5G or foldables isn’t enough. The winning brands will be those that adapt to local economic cycles, telco dynamics, and cultural preferences. A great idea in Silicon Valley means little if it doesn’t resonate in Nairobi or Lagos. The lesson is clear: adaptation is the true innovation.

Markets Punish Complacency – The RAZR Glory Years Blinded Motorola to Change

The RAZR V3 sold 130 million units, becoming one of the best-selling phones of all time. In Nairobi or Johannesburg, owning a RAZR was like wearing a Rolex. Yet, success bred comfort. Motorola failed to invest in the coming wave of touchscreens, app stores, and data-driven services. Markets, especially in tech, punish complacency brutally. Nokia is a good case study.

Within five years of the iPhone’s launch, Motorola had fallen from a cultural icon to an acquisition target. For Africa’s telcos, OEMs, and even fintechs, the warning is stark: today’s dominance can evaporate if tomorrow’s shifts are ignored. In 2025, Africa’s market is growing at 7% YoY in smartphone shipments, and tomorrow’s winners will be those who keep anticipating user needs, not those who bask in today’s sales.

Africa is the Future | With Over a Billion Potential Smartphone Users, This is the New Battlefield

Motorola’s U.S. glory is history, but the next trillion-dollar opportunity lies in Africa. The continent is home to 1.4 billion people, with a median age under 20 years—the youngest in the world. Smartphone penetration is still under 55%, meaning hundreds of millions of first-time buyers will enter the market this decade.

In Kenya alone, Safaricom has 43+ million mobile subscribers, with M-Pesa processing 70%+ of national transactions—a digital ecosystem begging for deeper smartphone integration. Nigeria, with 220+ million people, is adding millions of new internet users annually.

For Motorola, Africa is not just another region; it is the new frontier where telco partnerships, localized software, and affordable 5G can turn survival into resurgence. Ignore this, and history will repeat itself. Seize it, and Motorola could script a second golden age.

Will Motorola Rise Again?

The short answer: Yes, if it chooses Africa as its growth engine.

The long answer: Only if it stops looking back at its glory days and instead designs forward, for the realities of Nairobi, Lagos, and Johannesburg, and within the contexts of Africa’s needs, both present and emerging.

Motorola’s Legacy and Africa’s Promise

Motorola’s story is one of brilliance and downfall, but also resilience. It invented the mobile phone, gave us the flip phone, was defined as cool with the RAZR. And while it stumbled in the smartphone era, it has not disappeared.

In Kenya and Africa, Motorola is at a crossroads. With the right mix of affordability, partnerships, and innovation, it could rise again—not as the old Motorola, but as a reinvented giant tailored for Africa’s digital future.

Because here’s the truth: the next great chapter of the mobile phone revolution will be written in Africa. And Motorola, the company that started it all, still has a pen in its hand.

The question is: Will it write itself back into history? Keep tabs on JuaTech Africa for latest tech updates. Big question we seek to answer is inclined towards Motorola comeback in Africa.