For more than a decade, the smartphone industry trained the world to think in devices. Each year brought louder launches, sharper displays, faster processors, and incremental refinements framed as breakthroughs. The ritual was familiar and reassuring: compare specifications, debate value, upgrade, repeat.

Then the centre of gravity moved.

By the mid-2020s, innovation did not slow because technology failed—but because it matured. Performance ceilings rose high enough that, for most users, meaningful differences between premium smartphones blurred. Cameras became consistently excellent. Displays uniformly refined. Processing power began to exceed everyday needs. Yet even as novelty waned, loyalty hardened.

Users complained more.

They switched less.

That contradiction is not accidental. It is the clearest signal that competition has migrated away from individual devices and into something far more structural.

As we move through 2026 and into the years beyond, the defining struggle in mobile technology is no longer about which phone wins a launch cycle. It is about mobile ecosystems—the invisible architectures that bind devices, services, data, habits, and identity into systems that grow more valuable, and more difficult to leave, over time. These ecosystems increasingly shape productivity, economics, and access itself. In many markets, particularly across Africa, they are becoming as consequential as banks, operating systems, or public infrastructure.

This is not a passing phase.

It is a structural realignment—and it will define the next era of mobile power.

When Phone Battles Stop Explaining Reality

The smartphone market has entered its post-spec era. Hardware differentiation still exists, but its influence on daily experience has diminished. What once felt transformative now feels incremental. The upgrade cycle has lengthened. Enthusiasm has softened.

Yet brand gravity has intensified.

This is because competition no longer revolves around what a device can do in isolation. It revolves around what a system remembers, connects, and sustains over time. Users are no longer choosing phones. They are choosing environments—contexts in which their work, communication, payments, entertainment, and memory live.

The most important questions today are rarely spoken aloud. Which system quietly reduces friction in daily life, compounds value over time, and ultimately costs more to leave than to endure?

Those answers are not found in spec sheets or launch events. They are embedded in ecosystems.

What a Mobile Ecosystem Actually Is

A mobile ecosystem is often described as a collection of devices and services. This definition is technically correct—and strategically incomplete.

In reality, a mobile ecosystem is a continuity engine.

It links hardware, software, cloud services, data, and identity into a unified experience that persists across time. Files move without friction. Preferences follow the user. Payments become habitual. Authentication fades into the background. The system learns, adapts, and remembers.

The power of an ecosystem lies in accumulated context. Over time, it becomes less a tool and more a personal infrastructure. Leaving it means forfeiting familiarity, efficiency, and stored value. This is why ecosystems produce loyalty that appears irrational from the outside but feels practical from within.

Mainstream tech coverage often frames ecosystems as convenience. In truth, they are economic and behavioural architectures. They transform time, data, and habit into switching costs. They reward consistency and quietly punish fragmentation.

This is why ecosystem competition is not loud. It is patient.

Ecosystems as Power Infrastructure

Viewed through a wider lens, mobile ecosystems increasingly resemble infrastructure rather than consumer technology. Like roads, power grids, or financial networks, they shape movement and behaviour without demanding attention. Their influence is not theatrical. It is quiet, cumulative, and deeply consequential.

The true measure of an ecosystem’s strength is not how impressive it looks on launch day, but how indispensable it becomes over time. The most powerful ecosystems fade into the background, absorbing complexity so users can focus on outcomes. Their success is felt not through excitement, but through dependence.

This is where the real competition now lives.

Apple: Vertical Integration as Cognitive Control

Apple’s ecosystem remains the clearest expression of ecosystem power in its purest form. It is often described in emotional or aesthetic language—design, status, experience—but its real advantage is structural.

Apple controls the entire stack: hardware, silicon, operating systems, services, and increasingly, AI workflows. This vertical integration allows Apple to optimise not for flexibility, but for predictability. Devices behave consistently. Software updates feel incremental rather than disruptive. Workflows resume instead of restarting.

For users, this translates into reduced cognitive load. Decisions are quietly deferred to the system. Files appear where they are expected. Messages, notes, and tasks persist across devices without friction. Over time, Apple’s ecosystem becomes less a collection of products and more a personal operating environment.

The cost of leaving is not financial alone. It is psychological and practical. Years of habits, shortcuts, and stored context are not easily replaced. This is why Apple’s ecosystem lock-in is so durable, even in markets where its devices are expensive or its services incomplete.

In Africa, this same strength becomes a limitation. Apple’s ecosystem is powerful, but not deeply localised. Where mobile money, telco services, and informal economies dominate, Apple’s infrastructure feels partial. The lesson is not that Apple’s ecosystem is weak—but that ecosystem power must align with local realities to be fully realised.

Samsung: Breadth, Scale, and Embedded Presence

Samsung approaches ecosystem power from the opposite direction. Where Apple focuses on depth, Samsung builds breadth.

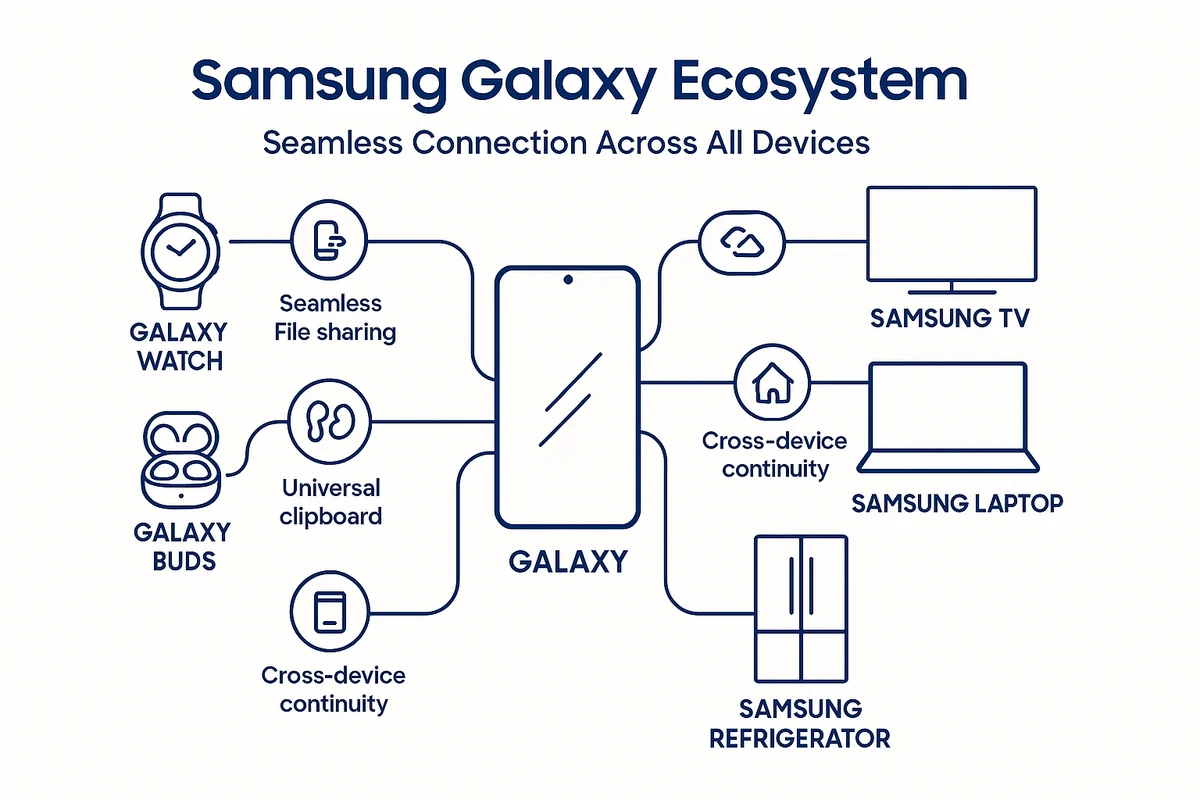

Its ecosystem spans smartphones, tablets, wearables, televisions, appliances, displays, memory, and enterprise infrastructure. Few companies touch as many layers of daily life. Samsung devices are present in homes, offices, hospitals, and factories—often invisibly.

Integration across this vast portfolio is looser than Apple’s, but the strategic advantage lies in presence. Samsung does not need to be the most elegant ecosystem to be the most embedded. In Android-dominant regions such as Africa, Samsung’s reach gives it ecosystem gravity through familiarity, availability, and trust built over time.

For many users, staying within the Samsung Galaxy ecosystem is less about conscious choice and more about continuity. Accessories work. Service centres exist. Repairs are possible. The brand feels dependable. This kind of ecosystem power is not glamorous, but it scales effectively in diverse markets.

Samsung’s challenge moving forward is coherence. As ecosystems become more AI-driven and context-aware, breadth alone may not be enough. The question is whether Samsung can tighten integration without sacrificing scale.

Xiaomi: Ubiquity, IoT, and Quiet Lock-In

Xiaomi’s ecosystem is frequently underestimated because it does not centre prestige or narrative dominance. This is a mistake.

Xiaomi’s long game is not the smartphone. It is ambient computing. Phones act as gateways into a broader ecosystem of connected devices—wearables, home appliances, sensors, and services—designed to be affordable, abundant, and always present.

The genius of Xiaomi’s ecosystem strategy lies in its subtlety. Lock-in is not enforced through exclusivity, but through ubiquity. When many small parts of daily life are connected through one platform, leaving becomes inconvenient rather than painful.

In emerging markets, this approach resonates deeply. Xiaomi’s ecosystem grows alongside users’ economic lives. As households expand, devices are added gradually. Loyalty is built through value and consistency, not aspiration.

Xiaomi demonstrates that ecosystem power does not require premium pricing or emotional branding. It requires relevance, scale, and patience. Over time, its ecosystem becomes less visible—and more entrenched.

Huawei: Ecosystem Resilience Under Constraint

Huawei’s ecosystem story is one of forced reinvention. Cut off from Google services and Western platforms, Huawei faced an existential challenge that few global brands have survived.

Its response was not to retreat, but to rebuild vertically.

Huawei doubled down on its own operating systems, services, and partnerships, particularly in regions where its infrastructure footprint was already strong. The result is an ecosystem defined not by abundance of choice, but by coherence under limitation.

This constraint-driven ecosystem reveals an important truth: ecosystems do not only grow through openness. They can also grow through necessity. When alternatives are unavailable, coherence becomes a competitive advantage.

In parts of Africa, Asia, and the Middle East, Huawei’s ecosystem remains relevant precisely because it integrates hardware, software, and network infrastructure in ways competitors cannot easily replicate. Its ecosystem power is contextual, regional, and resilient.

HONOR: Rebuilding Ecosystem Power with Strategic Independence

HONOR’s ecosystem story is one of the most misunderstood—and quietly impressive—developments in the post-Huawei landscape. Often viewed through the lens of its past, Honor today is better understood as a case study in ecosystem reconstruction under constraint, but without isolation.

Following its separation from Huawei, HONOR faced a rare challenge: how to retain ecosystem credibility without inherited infrastructure dominance. Its response has been deliberate rather than reactive. Instead of attempting to recreate Huawei’s vertically sealed model, HONOR has pursued a strategy of selective openness paired with ecosystem coherence.

At the device level, HONOR has invested heavily in cross-device continuity. Smartphones, tablets, laptops, and wearables are designed to communicate fluidly, prioritising productivity workflows, file continuity, and multi-screen collaboration. The emphasis is not spectacle, but flow—devices working together quietly, without demanding user intervention.

Crucially, HONOR’s ecosystem regains access to Google services while maintaining deep optimisation across its own software layer. This gives it a unique dual advantage: global compatibility paired with local ecosystem control. Where Huawei’s ecosystem is defined by necessity-driven independence, Honor’s is defined by strategic reintegration.

In markets like Africa, this matters. HONOR offers a rare proposition: premium-adjacent hardware, modern Android compatibility, and ecosystem-level features without the psychological or practical barriers associated with closed platforms. For users who want cohesion without confinement, Honor’s ecosystem feels pragmatic rather than prescriptive.

HONOR’s growing focus on AI-powered productivity, cross-device intelligence, and enterprise-friendly features signals its long-term intent. This is not a brand rebuilding momentum through devices alone, but one methodically layering ecosystem value to compete in a post-hardware-differentiation era.

What makes HONOR especially relevant to the ecosystem conversation is its middle-path strategy. It neither relies on total vertical control nor settles for platform dependency. Instead, it is constructing an ecosystem that is adaptive, interoperable, and regionally scalable.

In the years beyond 2026, as users become more conscious of lock-in and flexibility, Honor’s approach may prove instructive. It demonstrates that ecosystem power does not require absolute control—only disciplined integration, consistent experience, and strategic clarity.

HONOR’s ecosystem is not loud. But it is increasingly coherent. And coherence, in the ecosystem era, is a form of power.

Read our indepth feature articles on HONOR devices and entire ecosystem:

- HONOR Smartphone Naming Explained (2025 Kenya Master Guide)

- Best HONOR Smartphones to Buy in Kenya (2025 Edition) — JuaTech Africa Guide

- Is There Honor in the HONOR?

- HONOR Smartphones under 25K

OnePlus: The Risk of Ecosystem Thinness

OnePlus represents a growing vulnerability in the ecosystem era. It enjoys strong brand affinity, particularly among enthusiasts, but its ecosystem remains comparatively thin.

In a market where systems—not devices—anchor users, brand loyalty without ecosystem depth becomes fragile. As competitors integrate services, accessories, and AI workflows more tightly, standalone devices struggle to retain gravity.

OnePlus’s challenge is not product quality. It is ecosystem density. Without deeper integration, even well-loved brands risk becoming interchangeable within larger platforms they do not control.

Nothing: Identity First, Ecosystem Deferred

And then there is Nothing.

Nothing presents a rare counter-model in the ecosystem conversation. Where established players built ecosystems through scale, capital, or infrastructure, Nothing has pursued identity before integration.

Its transparency-driven design language, distinctive hardware aesthetics, and deliberate rejection of sameness stand out in a market dulled by convergence. Packaging, branding, and community engagement are not secondary—they are foundational.

This makes Nothing strategically compelling—and strategically exposed.

At present, Nothing’s ecosystem is light, modular, and intentionally restrained. It appeals to users who are fatigued by heavy lock-in and over-integration. But as ecosystems increasingly define long-term value, the question becomes unavoidable: can cultural differentiation sustain gravity without infrastructure?

Nothing’s trajectory matters because it tests whether a new ecosystem can be built deliberately, rather than inherited. Its future will reveal whether identity can mature into infrastructure—or whether, in the ecosystem era, depth eventually outweighs distinctiveness.

Why This Layer Matters

This ecosystem layer is not optional context. It is the foundation upon which the rest of the article stands.

Once ecosystems become infrastructure, competition stops being visible. Power accumulates quietly. Users do not feel controlled—but they feel unable to leave. Markets do not notice the shift—until it is complete.

This is why, beyond 2026 and into the years that follow, the brands that endure will not be those with the loudest launches, but those with the deepest systems.

And this is why the smartphone battle is no longer about devices. It is about who controls the infrastructure of modern digital life.

Nothing: Branding First, Ecosystem Later—A Strategic Challenge

Nothing enters this conversation as a deliberate outlier—testing whether ecosystem power must always be inherited through scale and infrastructure, or whether it can be constructed culturally, from the outside in.

Where most established players built their ecosystems through years of capital accumulation, vertical integration, or platform control, Nothing has taken a different path. It has prioritised identity before integration. Transparency-driven design, distinctive hardware aesthetics, and a carefully cultivated community are not supporting elements of the brand; they are the product. Packaging, visual language, and storytelling are treated as core infrastructure, not marketing garnish.

This approach makes Nothing strategically compelling—and strategically exposed.

In a market dulled by hardware convergence and iterative upgrades, Nothing competes where others no longer do: emotional differentiation. Its devices feel intentional rather than incremental. Its ecosystem, at least for now, is lighter, more modular, and more open than those of Apple, Samsung, or Xiaomi. For users fatigued by heavy lock-in and over-integration, this restraint is part of the appeal.

But restraint has limits.

Nothing does not yet compete on ecosystem depth. It does not control the full stack, nor does it anchor users through services, payments, or deeply embedded workflows. Instead, it orbits larger platforms while attempting to build gravity through coherence of identity. The long-term question this raises is unavoidable: can cultural clarity sustain ecosystem relevance without the density of infrastructure?

As mobile ecosystems increasingly become the primary competitive moat beyond 2026 and into the years that follow, brands like Nothing face a defining crossroads. Either brand affinity evolves into deeper platform integration, or the brand risks becoming a beautifully designed peripheral within ecosystems it does not control. The challenge is not relevance—Nothing has that in abundance. The challenge is endurance.

Nothing’s experiment matters because it remains unresolved. It asks whether brands can deliberately build ecosystems rather than inherit them through scale, whether differentiation can come before infrastructure, and whether community can ultimately harden into platform power. If Nothing succeeds, it could reshape how future brands enter an ecosystem-saturated market. If not, it will confirm a harder truth of the ecosystem era: that identity alone, no matter how compelling, eventually demands depth.

Nothing is not yet an ecosystem heavyweight.

But as a strategic stress test of how ecosystems might be built differently, it earns its place in this conversation.

Why 2026 Is Not the End Point—but the Threshold

Framing ecosystem competition around 2026 is useful—but incomplete. 2026 is not a finish line. It is a threshold.

Several forces converge around this period. Services revenue is overtaking hardware margins as the primary growth engine. Artificial intelligence is becoming context-dependent, rewarding systems that already possess continuity and history. User fatigue with complexity is deepening, increasing tolerance for closed but coherent platforms.

Beyond 2026, these forces intensify.

Ecosystems will expand beyond screens into environments. AI will become less about novelty and more about reliability. Payments, identity, health, and work will blur further. The mobile device will remain central, but it will increasingly function as a gateway rather than the destination.

In this future, ecosystems that fail to adapt will not collapse suddenly. They will erode quietly, losing relevance at the edges until recovery becomes impossible.

Africa’s Ecosystem Reality—and Why It Changes the Rules

Africa adds a crucial dimension to this discussion.

Here, ecosystems are rarely operating-system-led. They are SIM-anchored, telco-mediated, and payment-centric. Infrastructure often precedes software. Trust and access matter as much as innovation.

In Kenya, Safaricom’s influence illustrates this vividly. M-PESA is not simply a service layered onto devices; it is an economic substrate. Ecosystems that integrate into this layer gain disproportionate relevance. Those that do not remain peripheral, regardless of global reputation.

This reality explains why Apple’s ecosystem, while admired, often feels incomplete locally. It also explains why Android-based ecosystems, particularly those aligned with local distribution and services, embed more naturally into daily life.

Chinese brands understand this terrain. Their success is not only about pricing, but about presence—repair networks, service availability, and gradual ecosystem embedding. Loyalty here is earned through reliability before emotion.

As Africa’s digital economy expands beyond 2026, its ecosystems will not simply replicate Western models. Instead, they will evolve into hybrid systems where global platforms coexist with local infrastructure, distributing power across layers rather than concentrating it within a single brand.

What This Means—for Users, Brands, and Markets

For users, the ecosystem era demands a new kind of awareness. Buying a phone is no longer a short-term decision. It is an entry into a system that will shape costs, productivity, and flexibility for years to come.

For brands, ecosystem thinking is no longer optional. Market share without integration is fragile. Innovation without continuity is forgettable. The winners of the coming decade will not be those who launch the loudest, but those who embed the deepest.

For markets, particularly across Africa, ecosystems will increasingly define participation. Platforms that integrate payments, identity, and access will shape opportunity itself. Those that fail to align with local realities will struggle to matter, regardless of global scale.

Beyond Devices, Toward Systems That Endure

The smartphone war, as it was once understood, is over. What replaces it is quieter, more structural, and far harder to reverse. The centre of competition has shifted away from devices and into the systems that surround them—systems that accumulate value, memory, and dependence over time.

As we move through mobile ecosystems 2026 and into the years that follow, it is increasingly clear that these ecosystems are becoming the operating systems of modern life. They determine who moves faster and who slows down, who pays more and who pays later, who can leave easily and who cannot. Power no longer announces itself through launch events or spec sheets. It compounds invisibly, through continuity, habit, and integration.

From Apple’s vertical precision to Samsung’s expansive reach, Xiaomi’s quiet ubiquity, Huawei’s resilience under constraint, Honor’s strategic reinvention, and Nothing’s cultural challenge, the next phase of mobile competition will move beyond technical superiority. System coherence will decide the outcome—how effectively platforms adapt to human behaviour, local realities, and evolving needs across Africa and other global markets.

Looking past 2026, this dynamic will only intensify. Artificial intelligence will reward ecosystems that already possess context and continuity. Services will matter more than devices. Interoperability, payments, identity, and productivity will blur further. The smartphone will remain central, but increasingly as a gateway into larger, more consequential systems.

For users, this demands a shift in awareness. Choosing a phone is no longer a short-term purchase decision; it is an entry point into an ecosystem that shapes cost, capability, and freedom over time. For brands and markets, it is a reminder that relevance without depth is temporary—and that endurance belongs to those who build systems, not moments.

The question ahead is no longer which phone to buy.

It is which ecosystem you are already living inside—and whether it is still serving you.

If you want to understand where this shift leads next, and how it will reshape technology, markets, and everyday life in Africa and beyond, this conversation is only beginning.