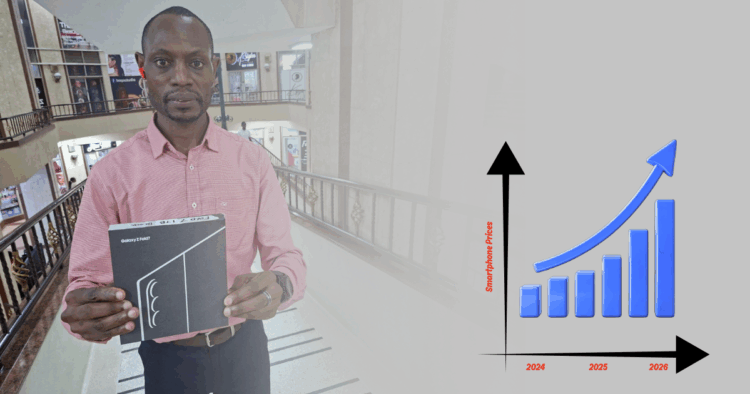

Smartphone prices in Kenya are already among the fastest-rising on the continent — and analysts warn that 2026 could bring another wave of increases as global component costs remain high and local tax decisions take effect. For many Kenyans, that makes 2025 one of the last “cheaper” windows to upgrade before devices move into a new price bracket.

Read our Analytica Report on Why Smartphone Pricing in Kenya Defies Global Models.

Prices Have Already Tripled – And the “Cheap Phone” Is Disappearing

Between 2019 and 2025, the average smartphone price in Kenya jumped from about KES 5,955 to roughly KES 18,979, according to data cited in a recent Business Daily report on device financing.

That shift has quietly killed the classic “10K phone” segment. Entry-level models that once sat comfortably under KES 13,000 have thinned out. In contrast, many devices in the Tecno Spark, Infinix Hot/Smart, and lower-end Samsung Galaxy A-series now sit in what used to be solid mid-range territory.

At the same time, Kenyan buyers are increasingly eyeing mid-range and premium phones — including Samsung’s Galaxy A and S series, Xiaomi’s Redmi Note line, and iPhones — as cameras, storage, and performance become central to work, content creation, and social life.

Why 2026 Could Be More Expensive Than 2025

Several forces are lining up that could push smartphone prices in Kenya even higher from 2026: These include:

Global component costs and memory prices

Research firm IDC projects that global smartphone average selling prices (ASPs) will climb to record highs in 2026, as rising memory chip costs hit the low- and mid-range Android segment tough.

Even though global shipments are expected to dip slightly, the total market value is forecast to reach nearly $579 billion in 2026 — driven more by higher prices than by increased unit volume.

Kenya’s tax and duty environment

In 2022, Kenya introduced a 50% import duty on smartphones, a policy aimed at encouraging local assembly. It also drove up retail prices almost overnight, particularly for popular mid-range imports.

A duty remission scheme currently allows local assemblers to import inputs at 0% duty, but this extension runs only until June next year, after which terms could change.

Separately, the Finance Bill debate has included proposals to remove VAT exemptions on locally assembled phones, a move that industry observers warn would make even “Made-in-Kenya” devices more expensive if passed as is.

Policy tug-of-war on affordability

Mobile operators and the GSMA are pushing for tax exemptions on entry-level smartphones — including scrapping VAT, customs duty, and import duty — to boost digital inclusion.

Whether policymakers choose tax cuts (to make basic phones cheaper) or stick with high levies (to protect revenue and the local assembly) will strongly shape Kenyan prices from 2026 onward.

Put simply: global costs are rising, and Kenya’s tax decisions could either soften or amplify that pain. From a consumer’s viewpoint, waiting to upgrade in the hope that prices will drop is increasingly a gamble.

Africa Is Growing, But Kenya Is Feeling the Squeeze

Across Africa, the smartphone story looks more optimistic.

In Q2 2025, Africa’s smartphone shipments grew 7% year-on-year to 19.2 million units, making the continent one of the best-performing regions globally.

Canalys and other analysts expect African shipments to continue growing over the next few years, even as global growth stays subdued.

But Kenya bucks this trend. While Egypt, Nigeria, and South Africa are benefiting from easing inflation and local manufacturing capacity, Kenyan shipments have been described as “struggling”, weighed down by higher device prices and weaker purchasing power.

For our JuaTech Africa readers, that means smartphones are becoming more accessible regionally — but locally, Kenya is facing a price wall.

“Lipa Mdogo Mdogo” Kenya: How Buyers Are Coping

As prices climb, Kenyans are changing how they buy phones. Financing, once reserved for big-ticket gadgets, has become mainstream for everyday smartphones.

A joint survey by the Central Bank of Kenya, FSD Kenya, and KNBS found that hire-purchase accounts tripled from 579,000 in 2021 to over 1.7 million by 2024, with smartphone financing a major driver.

Watu Simu, which began financing smartphones in 2022, reached one million customers within two years, focusing heavily on the Samsung Galaxy A series and other popular lines.

M-KOPA reports unlocking over KES 207 billion in credit for Kenyans, much of it tied to smartphones purchased via lipa-mdogo-mdogo with small daily or weekly payments.

Typical offers now advertise deposits as low as KES 3,500 and daily installments as low as KES 80–250, depending on the device — attractive numbers for workers, students, and hustlers who can’t drop 25–50K at once.

Financing keeps people connected — but it also means more Kenyans are entering long-term payment commitments that sometimes outlast the device’s practical lifespan or resale value.

JuaTech Africa Lens: What 2026 Means for Different Smartphone Buyers

From JuaTech Africa’s standpoint, the story isn’t just about rising smartphone prices in Kenya. It’s about making smart, timely decisions before the market shifts again.

Students & entry-level users

If you’re on a basic or failing device and rely on it for school, e-citizen services, or messaging, 2025 may be a safer time to upgrade to a dependable entry or lower-mid phone while promotion deals and current tax terms still apply.

Hustlers, riders, online sellers, small businesses

Your phone is a work tool. A solid mid-range device — think strong battery life, good network coverage, and enough storage for apps like Uber, TikTok, WhatsApp Business, Jumia, or Glovo — still offers good value today. Waiting for 2026 could mean the same tier jumps by several thousand shillings if global and local cost pressures stick.

Content creators & professionals

For you, camera quality, 5G, storage, and performance matter more than just price. Our analysis suggests that buying a capable mid-high device in 2025 and stretching its life to 3–4 years could be cheaper than chasing every yearly upgrade in a rising-price environment.

In all cases, financing should be treated like a loan, not a shortcut: compare total costs, check penalties, and avoid plans where a missed payment can lock your phone—or cost you far more than the cash price over time.

The Take-Home: A Narrow Window Before the Next Price Wave

Global data points to higher device costs into 2026, and Kenya’s own tax path could tighten or loosen the noose around phone affordability.

For now, though, 2025 still offers:

- active promos from brands fighting for African market share

- ongoing tax relief on assembly inputs

- current pricing before any new tax or policy changes land

For Kenyan and African consumers at large, the big question has shifted from “Which phone should I buy?” to “When should I buy — and on what terms?”

JuaTech Africa’s view:

If a smartphone upgrade is genuinely necessary for your work, learning, or business, delaying purely in the hope that prices will drop in 2026 may be a risky bet.

We’ll keep tracking how policy, prices, and products evolve — from Samsung Galaxy A and S series to Tecno and Infinix budget kings to iPhones and emerging locally assembled brands — so that when you spend, you spend with information, not guesswork.

Sign up on our Newsletter and keep abreast with our timely updates through our growing JuaTech Africa Community.