Can Safaricom’s Leaders Scale a Continental Vision? Leadership capacity, ecosystem building, and the diplomacy of expansion

Safaricom’s ambitions have outgrown Kenya. With over 10 million Ethiopian users and $1.2 billion in M-PESA transactions since August 2023, the telco giant is no longer just a local champion—it’s a regional contender. However, continental expansion requires more than just infrastructure. It demands leadership that can decode diplomacy, build trust, and architect ecosystems across fragmented markets.

This seventh installment of the JuaTech Africa’s Deep Dive Series interrogates whether Safaricom’s leadership is equipped to scale a vision that spans East Africa and beyond.

Leadership Capacity: Bench Strength or Bottleneck?

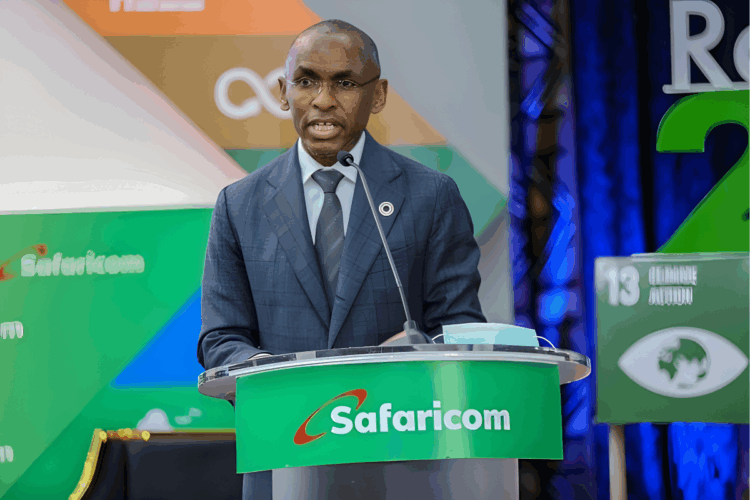

Safaricom’s executive suite—led by Peter Ndegwa (Group CEO) and Sitoyo Lopokoiyit (M-PESA Africa MD)—has delivered growth, but continental expansion requires adaptive intelligence, geopolitical fluency, and ecosystem empathy. Ethiopia’s entry exposed gaps in regulatory navigation and cultural nuance. Succession planning, regional representation, and leadership depth remain critical questions.

“We’re no longer talking about entry; we’re talking about leadership.”

— Peter Ndegwa

Ecosystem Building: Beyond Infrastructure

Safaricom’s success in Kenya was built on M-PESA’s ubiquity and network dominance. But exporting that model across East Africa requires ecosystem diplomacy. In Ethiopia, M-PESA now serves 2.4 million active users, with integrations into banks, fuel payments, and remittances.

As revealed in Part 6, data sovereignty and ethical expansion remain fragile frontiers. Trust architecture—interoperability, transparency, and user-first design—is now the new infrastructure.

The Diplomacy of Expansion

Ethiopia was Safaricom’s most ambitious market entry—and its most instructive. Delayed licensing, forex volatility, and cultural missteps revealed the regulatory ballet required for regional growth. CEO Wim Vanhelleputte’s diplomatic tone helped stabilize operations, but the lesson is clear: expansion is political.

Safaricom must master cultural intelligence—language, norms, and local nuance—to avoid the “Kenyan arrogance” trap. Regional expansion isn’t a rollout—it’s a relationship.

Comparative Scoreboard: Safaricom vs MTN, Airtel Africa, Orange

| Metric | Safaricom | MTN | Airtel Africa | Orange |

| Regional Footprint | Kenya | Global | Global | Global |

| Leadership Depth | Moderate | Deep | Moderate | Deep |

| Ecosystem Strategy | M-PESA-centric | Platform play | Telco-first | Infrastructure-heavy |

| Regulatory Wins | Ethiopia license | Pan-African | Strong in West Africa | Francophone Africa |

Sources: Safaricom Q3 FY25 Update, BusinessWorld, Africabwafrica.com

Risks & Realities

Talent Bottlenecks

Safaricom Ethiopia has hired over 1,700 local employees and indirectly supports thousands more. Yet leadership remains Nairobi-centric, with limited regional representation in executive decision-making. As Ethiopia’s mobile data usage surges—6.6GB per user per month, up from 3.6GB in FY24—the need for continentally fluent leadership becomes non-negotiable. Without a diversified pipeline, Safaricom risks misalignment with local markets and regulatory expectations.

Shareholder Pressure

Safaricom Group posted a KSh 79.4B ($615M) net profit in FY25, up 12.4% year-on-year. However, Ethiopia’s operations, while promising, remain loss-making—KSh 15B ($116M) in FY22 —with break-even projected for FY27 due to foreign exchange shocks. This tension between short-term returns and long-term ecosystem bets could stifle innovation, especially in developer outreach and financial inclusion.

Political Volatility

Ethiopia’s inflation rate, which once reached 33.8%, now hovers around 17%, with the IMF projecting a spike to 24% by June 2025 due to FX reforms. The Ethiopian Birr has depreciated 116.1% against the dollar in 2024 alone. These macroeconomic tremors directly impact Safaricom’s operational costs, pricing models, and user affordability—making resilience a leadership imperative.

Strategic Takeaways and a Wrap

Continental expansion demands a radical shift in leadership development. Safaricom can no longer rely on corporate veterans steeped in Nairobi boardroom culture—it must cultivate leaders fluent in regional nuance, geopolitical complexity, and ecosystem diplomacy. From Addis Ababa to Kigali, the stakes are different, and so must be the skillsets. Leadership must be decentralized, diverse, and continentally aware—capable of navigating fragmented markets with strategic empathy and adaptive intelligence.

Ecosystem building is no longer a soft ambition—it’s the new infrastructure. Trust, partnerships, and interoperability are the pillars of digital expansion. Safaricom’s future won’t be defined by how many towers it builds, but by how many developers, regulators, and startups it empowers. The telco must evolve into a platform orchestrator, not just a service provider. That means investing in open APIs, regional coalitions, and ethical data governance—because ecosystems thrive on trust, not dominance.

Finally, cultural humility must replace corporate bravado. Expansion isn’t a rollout—it’s a relationship. Safaricom must shed the “Kenyan arrogance” stereotype and embrace local nuance, language, and leadership. Africa doesn’t need another telco—it needs a digital backbone built on respect, reciprocity, and relevance.

JuaTech Africa’s Big Question

“Africa doesn’t need another telco. It needs a digital backbone. Can Safaricom’s leaders rise to the occasion?”

Subscribe to the JuaTech Africa Newsletter and join the continent’s most strategic tech community. Get exclusive insights, deep dives, and bold commentary on Africa’s digital transformation.

Previous (Read Part 6) | Next (Part 8): Part 8 — Ethiopia’s Crucible: Safaricom’s Boldest Bet Yet A high-stakes market entry that could validate — or break — its continental thesis.