Lessons from Failed Ventures

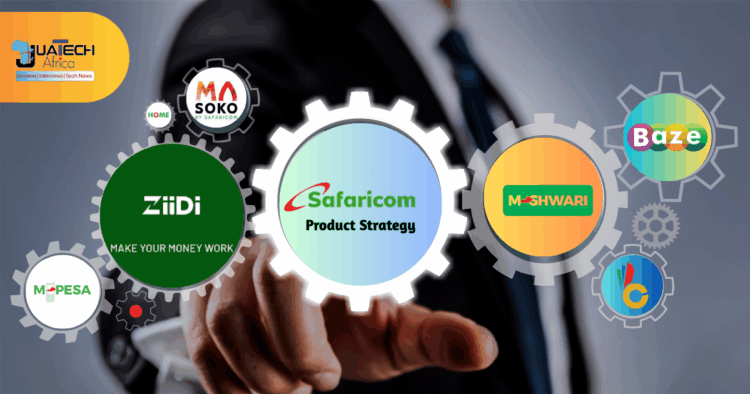

What’s up with Safaricom’s Product Playbook? Its dominance in mobile money and connectivity has not insulated it from product misfires. The most prominent example is Masoko, the e-commerce platform launched in 2017 with ambitions to rival Jumia and Kilimall. Positioned as a pan‑African online marketplace, Masoko promised to leverage Safaricom’s brand trust, M-Pesa integration, and logistics partnerships to capture Kenya’s growing online retail segment.

On paper, the fundamentals appeared strong: Kenya’s e-commerce market was valued at US$1.1 billion in 2017 (Statista), smartphone penetration was increasing, and M-Pesa provided a frictionless payment solution. Yet, by 2020, Masoko had quietly scaled back operations, pivoting to a smaller B2B model.

Previous (Part 3) | Next (Part 5)

Why it failed:

- Execution Gaps: Masoko struggled with vendor onboarding, product variety, and delivery reliability. These are strategic areas where Jumia had already built operational muscle.

- Market Timing: While urban adoption of e-commerce was growing, rural logistics and consumer trust in online shopping lagged.

- Competitive Landscape: Jumia’s aggressive marketing and established vendor network created a moat that Masoko underestimated.

- Internal Focus Drift: Safaricom’s core revenue engines — M-Pesa and mobile services — consumed leadership attention, leaving Masoko without the sustained strategic push needed to scale.

Masoko was not alone. Baze, Safaricom’s video-on-demand platform launched in 2021, aimed to monetise Kenya’s appetite for local content. Despite competitive pricing (KES 10/day), it failed to gain traction against YouTube’s free model and Netflix’s premium library. Similarly, the Little Cab ride-hailing partnership, launched in 2016 to challenge Uber and Bolt, never achieved significant market share.

The common thread in these ventures is not a lack of resources, but a misalignment between product ambition and execution discipline. Safaricom’s brand can open doors, but it cannot substitute for deep operational expertise in unfamiliar verticals.

Spotlight on Ziidi MMF and Financial Inclusion

In contrast, the Ziidi Money Market Fund (MMF), launched in 2024, demonstrates Safaricom’s ability to innovate successfully when it plays to its strengths. Ziidi offers M-Pesa users a zero-fee, daily‑interest savings product, with funds invested in regulated money market instruments.

Why it works:

- Seamless Integration: Ziidi is embedded directly into the M‑PESA app, eliminating onboarding friction.

- Low Barrier to Entry: Minimum investment is just KES 1, making it accessible to low-income users.

- Daily Liquidity: Users can withdraw funds instantly, a critical feature in markets where liquidity needs are unpredictable.

- Regulatory Alignment: Operates under the Capital Markets Authority’s oversight, boosting trust.

Within 6 months of launch, Ziidi had attracted 1.8 million active users and mobilised over KES 12.4 billion in assets under management (Safaricom FY25 Q4 report). Early adoption has been strongest among urban youth and SMEs seeking to earn returns on idle cash.

Ziidi’s appeal lies in its alignment with Safaricom’s financial inclusion narrative. It leverages existing infrastructure (M-Pesa), addresses a real market gap (low-yield savings options), and benefits from Safaricom’s distribution power. Unlike Masoko, Ziidi operates in a domain where Safaricom already has deep expertise — digital finance — and where its brand trust is a decisive competitive advantage.

What the Hits and Misses Reveal About Innovation Culture

A look at Safaricom’s Product Playbook reveals ambition, risk, and caution. Its product history reveals a duality in its innovation culture: disciplined dominance in core adjacencies, and uneven performance in non-core experiments.

Strengths:

- Platform Leverage: Products like M‑Shwari, Fuliza, and now Ziidi succeed because they ride on M‑PESA’s rails, tapping into an existing, trusted user base.

- Distribution Power: With over 43 million subscribers, Safaricom can achieve rapid product awareness and adoption at scale.

- Regulatory Capital: Its relationships with regulators enable faster approvals for financial products compared to smaller players.

Weaknesses:

- Execution in New Verticals: Ventures like Masoko and Baze show that Safaricom’s operational excellence in telecom and fintech does not automatically translate to e-commerce or content streaming.

- Innovation Pace: While Safaricom is methodical, it can be slower to iterate compared to nimble startups. This is a disadvantage in fast-moving consumer tech segments.

- Risk Appetite: The company tends to retreat quickly from underperforming ventures. This protects margins but can limit long-term learning.

Comparative Lens:

- MTN Group has successfully diversified into mobile banking, insurance, and music streaming across multiple African markets, often through partnerships that bring in external expertise.

- Airtel Africa has focused on scaling Airtel Money and partnering with global fintechs, avoiding heavy investment in unrelated verticals. Safaricom’s mixed record suggests that its most sustainable path to innovation leadership lies in deepening and diversifying within its fintech and connectivity core, rather than chasing every adjacent opportunity.

Strategic Implications:

- Partnership Over Build‑From‑Scratch: In non-core areas, Safaricom could benefit from joint ventures with domain specialists, reducing execution risk.

- Innovation Governance: Establishing a dedicated venture arm with its own P&L could insulate experimental products from the short-term performance pressures of the core business.

- Customer‑Centric Validation: Embedding rapid prototyping and user feedback loops could help avoid large-scale misfires.

Closing Thought | Safaricom’s Product Playbook

The arc from Masoko to Ziidi is more than a tale of failure and redemption. It is a case study in the strategic discipline of knowing where you can win. Safaricom’s brand, infrastructure, and regulatory capital give it unmatched leverage in fintech and connectivity. When it leverages these strengths, as Ziidi demonstrates, it can deliver products that scale rapidly, resonate deeply, and reinforce its market leadership.

But when it strays too far from its core without the operational muscle to match its ambition, even the most trusted brand in East Africa can stumble. The lesson for Safaricom — and for any market leader — is clear. In innovation, the rails you own matter as much as the destinations you chase.

Previous | Next (Part 5): Infrastructure & Accessibility — 5G Dreams, 2G Realities: The Connectivity Gap Safaricom Must Close. We embark on reality checks, exploring digital literacy as an invisible problem, and the Last Mile venture to increase internet connectivity.

Are you following our series? Please share your thoughts with us so we can gather feedback as we develop the JuaTech Africa platform. Your comment, compliment or point of view will be highly appreciated as feedback. Reach us through our social media channels.