A Side-by-Side Look at Risk, Returns, and Accessibility for Kenyan Investors

In a digital-first economy where mobile money is king and financial literacy is rapidly evolving, the question of where to invest your KES 25,000 is more than just a personal decision—it’s a reflection of your mindset, your risk appetite, and your belief in the future of money. For many Kenyans, especially first-time investors, the choice often comes down to two paths: the bold, global promise of Bitcoin or the safe, regulated comfort of Safaricom’s Ziidi Money Market Fund (MMF).

This guide is designed to help you make that decision with clarity, confidence, and context. Whether you are a hustler, a student, a tech-savvy entrepreneur, or a curious saver, we will walk you through everything you need to know—from how to invest, what to expect, and how to protect your money—to ensure your KES 25,000 works smarter for you.

1. Why This Matters: The Rise of the Kenyan Retail Investor

Kenya is experiencing a financial awakening. With over 30 million M-PESA users, increasing smartphone penetration, and a growing appetite for alternative investments, more Kenyans are asking: “Where else can I grow my money besides savings accounts and chama contributions?”

The answer isn’t simple—but it’s exciting. Bitcoin offers exposure to a global asset class that’s decentralized, borderless, and potentially explosive in returns. Safaricom’s Ziidi MMF, on the other hand, offers daily interest, instant liquidity, and regulatory protection. Both are valid. But they serve different investor personas.

2. Bitcoin: The Digital Gold of Our Time

Bitcoin is not just a currency—it’s a movement. Born in 2009 as a response to the global financial crisis, it represents a new way to store and transfer value without the need for banks, governments, or intermediaries. It’s powered by blockchain technology, which ensures transparency, security, and immutability.

Why Bitcoin Appeals to Kenyan Investors

Global Access | Own Bitcoin Anytime, Anywhere

Bitcoin is borderless. Whether you’re in Nairobi, Kisumu, or Turkana, you can buy, hold, and transfer BTC without needing a bank or broker. All you need is internet access and a crypto wallet. This global accessibility empowers Kenyan investors to participate in international finance, bypassing traditional gatekeepers and currency limitations.

Limited Supply | Only 21 Million BTC (Deflation by Design)

Unlike fiat currencies, which can be printed endlessly, Bitcoin has a fixed cap of 21 million coins. This scarcity makes it deflationary—meaning its value tends to rise as demand increases and supply remains fixed. For Kenyan investors facing inflation or currency devaluation, Bitcoin offers a hedge against loss of purchasing power.

Mobile-Friendly | Trade BTC via Binance, Yellow Card, or Trust Wallet

Kenya’s mobile-first economy makes Bitcoin adoption seamless. Apps like Binance, Yellow Card, and Trust Wallet allow users to buy, sell, and store BTC directly from their phones. With M-PESA integrations and low entry barriers, even first-time investors can start with as little as KES 500 and scale up gradually.

Potential for High Returns | Bitcoin Has Outperformed Traditional Assets

Over the past decade, Bitcoin has delivered exponential returns—far outpacing stocks, bonds, and real estate. While volatile, its long-term trajectory has rewarded early adopters. For Kenyan investors willing to diversify and learn, BTC offers a chance to build wealth outside conventional systems, especially during global market shifts.

But with great potential comes great volatility. Bitcoin can swing ±30% in a matter of weeks. That’s why education, strategy, and emotional discipline are key.

3. Safaricom Ziidi MMF: Stability Meets Simplicity

Ziidi MMF is Safaricom’s entry into the world of regulated investment. It’s a collective fund that pools money from thousands of Kenyans and invests it in low-risk instruments, such as Treasury bills, commercial paper, and fixed deposits. Ziidi MMF is approved by the Capital Markets Authority and managed by Standard Investment Bank and ALA Capital Limited.

Why Ziidi Works for First-Time Investors

Daily Interest: Your Money Grows Every Day

Ziidi rewards consistency by compounding interest daily, meaning your KES 25,000 starts earning from day one. Unlike traditional savings accounts that calculate monthly returns, Ziidi ensures visible growth every 24 hours—ideal for first-time investors who want to see progress fast and build confidence in digital finance.

Regulated by CMA: Your Investment Is Protected by Law

Ziidi operates under the oversight of Kenya’s Capital Markets Authority (CMA), ensuring full compliance with financial regulations. This legal backing provides first-time investors with peace of mind, knowing their funds are managed transparently, ethically, and with safeguards against fraud or mismanagement—essential for building trust in fintech platforms.

Instant Liquidity: Withdraw Anytime via M-PESA

Ziidi offers unmatched flexibility by allowing users to access their funds instantly through M-PESA. Whether you are covering an emergency or reinvesting elsewhere, your money is never locked away. This real-time liquidity makes Ziidi ideal for new investors who value control, convenience, and seamless integration with Kenya’s mobile money ecosystem.

No Fees: No Transaction Costs or Hidden Charges

Ziidi eliminates the usual barriers to entry by charging zero transaction fees. There are no deductions on deposits, withdrawals, or interest earned*—what you see is what you get. For first-time investors, this transparency builds trust and ensures that every shilling works toward your financial growth, rather than being diverted to platform overhead.

Note: M-PESA daily and per-transaction limits still apply

As of August 2025, Ziidi MMF offers a net annual return of 9.61%, which translates to about KES 1,200 in gains over 6 months on a KES 25,000 investment.

4. How to Invest KES 25,000 in Bitcoin

Here’s a step-by-step guide for first-time Kenyan investors:

Step 1: Choose a Trusted Platform

- Binance: Global exchange with KES support.

- Yellow Card: Africa-focused, mobile-friendly.

- Paxful: Peer-to-peer, ideal for M-PESA users.

Step 2: Create a Wallet

- Trust Wallet or MetaMask for mobile.

- Ledger Nano or Trezor for hardware security.

Step 3: Buy Bitcoin

- Deposit KES via mobile money or bank transfer.

- Convert to BTC (you will get ~0.00176 BTC for KES 25,000 at current prices).

Step 4: Secure Your Investment

- Enable 2FA.

- Store private keys offline.

- Avoid leaving funds on exchanges.

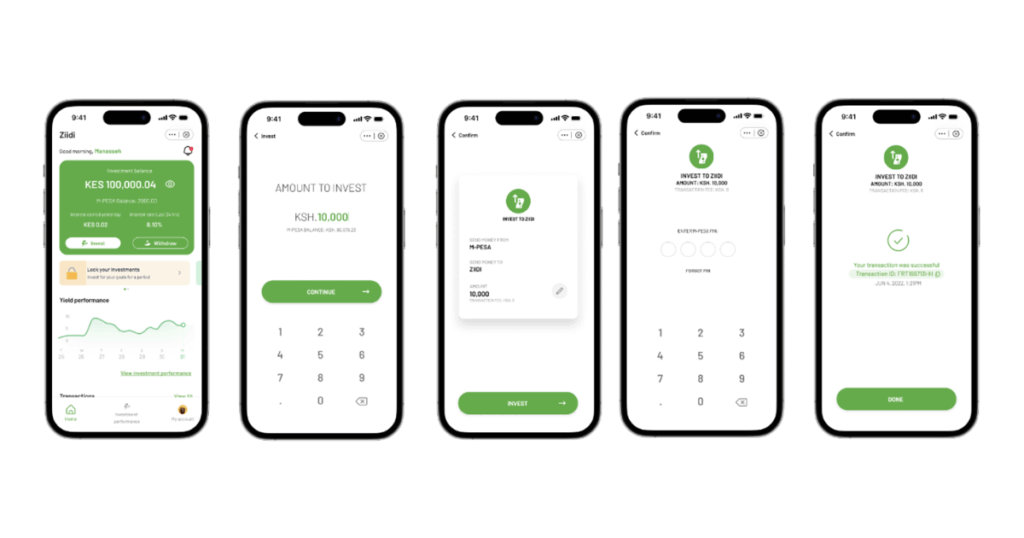

5. How to Invest KES 25,000 in Ziidi MMF

Step 1: Access Ziidi via M-PESA App or USSD (334#)*

- Navigate to “Ziidi MMF” under financial services.

Step 2: Deposit Funds

- Minimum investment is KES 100.

- No upper limit.

Step 3: Track Your Growth

- Interest accrues daily.

- Withdraw anytime with zero fees.

6. What to Watch Over the Next 6 Months

Bitcoin Trends: What to Watch (Aug 2025 – Feb 2026)

Global ETF Adoption: Institutional Money Is Reshaping the Market

What’s happening?

- Bitcoin ETFs (Exchange-Traded Funds) are now mainstream. BlackRock’s iShares Bitcoin Trust (IBIT) holds over 781,000 BTC, making it the second-largest holder globally, behind only Satoshi Nakamoto.

- ETFs simplify access for pension funds, banks, and sovereign wealth funds—bringing regulated capital into crypto.

Why does it matter?

- ETFs lock up Bitcoin in custodial vaults, reducing circulating supply and creating supply shocks.

- Institutional inflows are driving price stability and long-term valuation growth. Analysts project BTC could hit $200,000 by the end of 2025.

Kenyan East African angle:

- ETFs are the gateway for African pension schemes and fintechs to gain exposure without direct crypto custody.

- Expect local financial advisors and asset managers to start exploring ETF-linked products.

Regulatory Clarity: Kenya’s VASP Bill Is a Game-Changer

What’s happening?

- Kenya’s Virtual Asset Service Providers (VASP) Bill, 2025, is under parliamentary review.

- It introduces licensing, AML/KYC protocols, and consumer protection for crypto exchanges, wallets, and payment processors.

Key features:

- Requires VASPs to register with CBK and CMA.

- Prohibits individuals from operating unlicensed crypto services.

- Targets on-ramp/off-ramp providers—those converting fiat to crypto and vice versa.

Why does it matter?

- Kenya is transitioning from a regulatory vacuum to a structured framework.

- This will unlock banking partnerships, reduce fraud, and attract global exchanges.

What to Watch for:

- VAT exemptions for digital assets.

- Licensing clarity for OTC platforms and peer-to-peer traders.

- Youth-led startups may face compliance hurdles, but also gain legitimacy.

Market Cycles: Post-Halving Momentum Is Still in Play

Did you know?

- Bitcoin’s last halving was in April 2024. Historically, BTC rallies 9–18 months post-halving, peaking before a correction.

- We are now in the euphoria/distribution phase, with a projected top around September–October 2025.

Cycle breakdown:

| Phase | Timeline (Post-Halving) | Market Behavior |

| Accumulation | 0–6 months | Slow growth, low volatility |

| Euphoria | 6–18 months | Parabolic rise, media hype |

| Distribution | 18–24 months | Double top, profit-taking |

| Reversion | 24–30 months | Major correction, price reset |

Why does this matter?

- Retail traders often enter during euphoria and exit during panic.

- Institutional players accumulate early and hold through cycles.

Best Strategies for Kenyan and East African Bitcoin Champions:

- Educate buyers on cycle psychology.

- Position content around risk management, not just price hype.

- Use historical charts to guide retail timing and avoid FOMO-driven losses.

4. East African Integration: Crypto Education & Mobile Wallets Are Scaling

What’s happening?

- In Kibera, Nairobi, vendors and informal workers are using Bitcoin for daily purchases.

- Mobile money platforms like M-Pesa are integrating crypto wallets for remittances and savings.

- Fintechs like AfriBit are running grassroots education programs on wallet safety and crypto literacy.

Why does it matter?

- Crypto is becoming a practical tool, not just a speculative asset.

- Mobile-first adoption bypasses traditional banking barriers.

Key enablers:

- Wallets like Phoenix, Bitnob, and Machankura support USSD-based crypto access.

- Remittance corridors are shifting from Western Union to crypto rails.

Strategic implications:

- Retailers should explore crypto payment acceptance.

- Content creators can build wallet onboarding guides for low-literacy users.

- Training programs should focus on private key management, scam prevention, and cross-border use cases.

Ziidi MMF Trends

CBK Rate Adjustments |Interest Rates affect MMF Yields

The Central Bank of Kenya’s monetary policy has a direct impact on MMF returns. When CBK raises benchmark rates to curb inflation, MMFs typically offer higher yields. Conversely, rate cuts may soften returns. Ziidi investors should closely track CBK decisions, as they signal shifts in earning potential and broader economic health.

Inflation Management: MMFs Remain Attractive as Inflation Hedges

In times of rising prices, MMFs like Ziidi offer a buffer against inflation erosion. By investing in short-term government securities and commercial paper, they preserve capital while generating modest returns. For Kenyan savers, MMFs offer a safer alternative to idle cash, helping to maintain purchasing power during volatile economic cycles.

Explosive User Growth: Over 450,000 Kenyans Joined Ziidi in Its First Month

Ziidi’s explosive uptake reflects a hunger for accessible, low-risk investment tools. With over 450,000 users onboarded in just weeks, it’s clear that mobile-first, fee-free investing resonates with everyday Kenyans. This momentum signals a shift in financial behavior, where saving is no longer a passive act but a strategic and digitally empowered process.

7. Security: Protecting Your Investment

Bitcoin

- Pros: Decentralized, censorship-resistant, borderless.

- Cons: Prone to scams, hacks, and emotional trading.

Tips

- Never share your seed phrase.

- Use cold wallets for long-term storage.

- Avoid pump-and-dump Telegram groups.

Ziidi MMF

- Pros: CMA-regulated, PIN-protected, backed by government securities.

- Cons: Lower upside, subject to 15% withholding tax.

Tips

- Use strong M-PESA PINs.

- Monitor interest daily.

- Reinvest gains for compounding.

8. Monitoring Your Investment

Bitcoin

Use Apps like CoinMarketCap, TradingView, or Binance

These platforms offer real-time price tracking, historical charts, and market analytics. Kenyan investors can monitor Bitcoin trends, compare altcoins, and access global data—all from a smartphone, anytime.

Set Price Alerts

Price alerts notify you instantly when Bitcoin hits your target buy or sell level. This helps you act quickly, avoid emotional decisions, and stay disciplined—especially in volatile markets.

Follow Crypto News on CoinDesk, X (Twitter), or YouTube

Staying informed through trusted crypto news sources helps you anticipate market moves, understand global sentiment, and spot regulatory updates. It’s essential for making smart, timely investment decisions.

Ziidi MMF

- Track growth via M-PESA App or USSD.

- View interest statements.

- Withdraw or top up instantly.

Track Growth via M-PESA App or USSD

Monitor your Ziidi MMF balance and daily interest accrual directly from your phone. Whether using the M-PESA app or dialing *334#, you stay informed in seconds—no paperwork, no hassle.

View Interest Statements

Access monthly or quarterly statements to see how your money is growing. These summaries help you track performance, validate returns, and make data-driven decisions for future top-ups or withdrawals.

Withdraw or Top Up Instantly

Need liquidity or want to re-invest? Ziidi lets you withdraw or deposit funds instantly via M-PESA. It’s flexible, fast, and ideal for managing short-term goals or addressing emergency cash flow needs.

9. Projected Outcomes After 6 Months

To help you make an informed decision, we have simulated both investments for your reference.

Caution: These are ideal scenarios, used for illustrative purposes only, with data provided for informational purposes. Use data and information with discretion in real-life situations.

Bitcoin Scenarios

| BTC Price in 6 Months | Value of 0.00176 BTC | Gain/Loss |

| KES 10M (Projected future price of 1 N=Bitcoin in 6 months time) | KES 17,600 | -KES 7,400 |

| KES 14.2M (flat) | KES 25,000 | No gain |

| KES 18M | KES 31,680 | +KES 6,680 |

| KES 25M | KES 44,000 | +KES 19,000 |

Ziidi MMF Outcome

- Annual net return: 9.61%

- 6-month return: ~4.8%

- Final value: KES 26,200*

- Gain: KES 1,200*

10. Strategic Comparison | Bitcoin or Safaricom’s Ziidi MMF?

| Feature | Bitcoin | Safaricom Ziidi MMF |

| Risk Level | High | Low |

| Return Potential | High (speculative) | Moderate (predictable) |

| Liquidity | Medium (depends on exchange) | High (instant via M-PESA) |

| Regulation | Unregulated | CMA-regulated |

| Security | User-dependent | PIN-protected, institutional |

| Monitoring Tools | Global apps | M-PESA App, USSD |

| Taxation | None (currently) | 15% withholding tax |

| Accessibility | Requires crypto literacy | Simple, mobile-first |

11. Realities of the Kenyan Amateur Investor

Let’s be honest. Most Kenyans aren’t trading crypto on laptops with dual monitors. They are using budget smartphones, juggling side hustles, and trying to stretch every shilling. That’s why education is key.

It is the reason for this very post.

Common Concerns

- “What if I lose my money?”

- “Is Bitcoin a scam?”

- “How do I even start?”

- “Can I trust these apps?”

What You Need to Know

- Bitcoin is not a scam—but it’s risky.

- You don’t need to buy a whole BTC. Start with KES 500.

- Use trusted platforms. Avoid WhatsApp “investment groups.”

- Learn before you leap. Watch YouTube tutorials. Read blogs. Ask questions.

Bitcoin is not a scam—but it’s a risky investment.

Bitcoin itself is a legitimate digital asset built on transparent blockchain technology. However, its price is highly volatile, and bad actors often exploit its complexity to run scams. Investors must understand that while Bitcoin isn’t fraudulent, it requires caution, thorough research, and emotional discipline to avoid costly mistakes.

You don’t need to buy a whole BTC. Start with KES 500

Bitcoin is divisible into tiny units called satoshis, so you can invest small amounts—like KES 500—without needing to buy a full coin. This makes it accessible to everyday Kenyans. Platforms like Binance or Changelly allow for fractional purchases, enabling you to learn and grow gradually without overexposing your finances.

Use trusted platforms. Avoid WhatsApp “investment groups”

Stick to regulated exchanges like Binance, Kraken, or OKX that offer secure wallets, KYC verification, and transparent pricing. Avoid WhatsApp groups promising guaranteed returns—they often use fake testimonials and pressure tactics to steal your money. If it sounds too good to be true, it probably is.

Learn before you leap. Watch YouTube tutorials. Read blogs. Ask questions

Before investing, educate yourself through credible resources. Start with How to Invest In Crypto for Beginners 2025 [FREE COURSE] for foundational knowledge, or How To Invest In Crypto As A BEGINNER In 2025 [Full Tutorial] for strategy. These guides demystify crypto, explain wallets, and help you avoid rookie mistakes.

Why Bitcoin Deserves a Place in Your Portfolio

Even if you are not ready to go all-in, Bitcoin deserves a seat at your financial table. It’s not just about chasing profits—it’s about participating in a global financial revolution. For Kenyan investors, especially digital natives and mobile-first entrepreneurs, Bitcoin offers:

- Diversification: It’s a hedge against inflation and currency devaluation.

- Empowerment: You control your money, not a bank or government.

- Education: Learning crypto builds digital literacy and global awareness.

- Opportunity: Early adopters often benefit most—if they invest wisely.

But this isn’t a call to abandon traditional finance. It’s a call to expand your toolkit. Bitcoin and MMFs can coexist in a smart, balanced portfolio. You can start small, learn as you go, and build confidence over time.

The Hybrid Strategy: Smart Investing for Kenyan Realities

Here’s a practical approach for the modern Kenyan investor. We share the concerns of many Kenyans, both within the country and abroad, who want to invest and expand their wealth creation portfolio but are limited by a lack of knowledge and the actual steps required. Time for low-value, low-risk investments is over.

Split Your KES 25,000: Put KES 15,000 in Bitcoin and KES 10,000 in Ziidi MMF

Diversify across volatility and stability. Bitcoin offers long-term upside potential but experiences significant fluctuations. Ziidi MMF, accessed via M-PESA, delivers daily interest with zero transaction fees. This split balances growth potential with liquidity, making it ideal for Kenyan investors seeking exposure to digital assets while preserving emergency access and compounding returns.

Track Both: Monitor BTC Price Movements and MMF Interest Accrual Weekly

Use apps like Binance, CoinMarketCap, or TradingView to track Bitcoin’s price trends and set alerts. For Ziidi MMF, dial *334# or use the M-PESA app to view daily interest growth. Weekly tracking builds discipline, helps identify patterns, and empowers smarter decisions—especially when markets fluctuate or interest rates change.

Secure Your Crypto: Use Trusted Wallets and Avoid Emotional Trading

Choose wallets like Ledger Nano X for cold storage or Zabira for local exchange access. Always enable two-factor authentication (2FA) and store recovery phrases offline. Avoid panic buying or selling—emotional trades often lead to losses. Stick to your strategy, use limit orders, and never invest more than you can afford to lose.

Reinvest MMF Gains: Compound Your Returns for Long-Term Growth

Instead of withdrawing interest monthly, reinvest it to grow your principal. Ziidi MMF allows instant top-ups via M-PESA, making compounding seamless. Over time, this snowballs your returns—at current rates (around 11.30%), a KES 10,000 principal could grow to approximately KES 11,130 over one year—though rates fluctuate.

It’s the most straightforward path to passive income and wealth accumulation, subject to market conditions.

Educate Yourself: Follow JuaTech Africa, Read Blogs, Watch Tutorials, Join Credible Communities

Knowledge is your best defense. Follow JuaTech Africa for regionally relevant insights. Watch How to Invest In Crypto for Beginners 2025 [FREE COURSE] for foundational clarity, and How To Invest In Crypto As A BEGINNER In 2025 [Full Tutorial] for strategy. Join Telegram groups, attend webinars, and ask questions before committing funds.

This hybrid strategy gives you exposure to high-growth potential while anchoring your funds in a stable, regulated environment. It’s ideal for first-time investors who want to learn, grow, and stay protected.

14. Final Thoughts: From Curiosity to Confidence

Investing is no longer reserved for the wealthy or the well-connected. In Kenya today, anyone with a smartphone and KES 100 can start building wealth. But the real power lies in understanding what you are investing in—and why.

Bitcoin is bold, global, and transformative. Ziidi MMF is a safe, local, and reliable option. Both have a role to play. The key is to align your choices with your goals, your risk tolerance, and your financial literacy journey.

So whether you are a student saving for school fees, a boda rider looking to grow your hustle, a single mother concerned about securing the future of your 6-year-old child, or a tech entrepreneur building your empire—this guide is your launchpad. Start small. Stay curious. Think long-term.

And remember: the best investment isn’t just in Bitcoin or MMFs—it’s in your mindset, your education, and your ability to make informed decisions.

Disclaimer (S)

This post is for educational purposes only and does not constitute financial advice. Readers must consult a qualified financial advisor before making decisions.

Rates fluctuate with times and global situations, which can have a significant impact on your return on investment.

Past performance is not indicative of future results. Juatech Africa and the author of this post is not providing personalized financial advice.